Use of a Trial Balance to Record Adjusting Entries in T Accounts Lewis and Associates has been

Question:

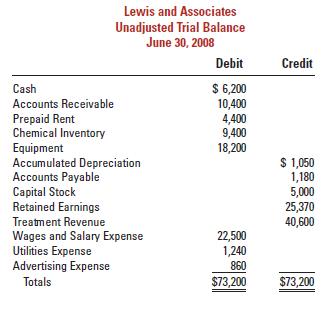

Use of a Trial Balance to Record Adjusting Entries in T Accounts Lewis and Associates has been in the termite inspection and treatment business for five years. An unadjusted trial balance at June 30, 2008, follows.

The following additional information is available:

a. Lewis rents a warehouse with office space and prepays the annual rent of $4,800 on May 1 of each year.

b. The asset account Equipment represents the cost of treatment equipment, which has an estimated useful life of ten years and an estimated salvage value of $200.

c. Chemical inventory on hand equals $1,300.

d. Wages and salaries owed but unpaid to employees at the end of the month amount to $1,080.

e. Lewis accrues income taxes using an estimated tax rate equal to 30% of the income for the month.

Required 1. Set up T accounts for each of the accounts listed in the trial balance. Based on the additional information given, set up any other T accounts that will be needed to prepare adjusting entries.

2. Post the month-end adjusting entries directly to the T accounts but do not bother to put the entries in journal format first. Use the letters

(a) through

(e) from the additional information to identify the entries.

3. Prepare a trial balance to prove the equality of debits and credits after posting the adjusting entries.

4. On the basis of the information you have, does Lewis appear to be a profitable business?

Explain your answer.

Step by Step Answer:

Financial Accounting The Impact On Decision Makers

ISBN: 9780324655230

6th Edition

Authors: Gary A. Porter, Curtis L. Norton