At the end of fiscal year 2021, Hammond Legal Services and Delectable Doughnuts reported these adapted amounts

Question:

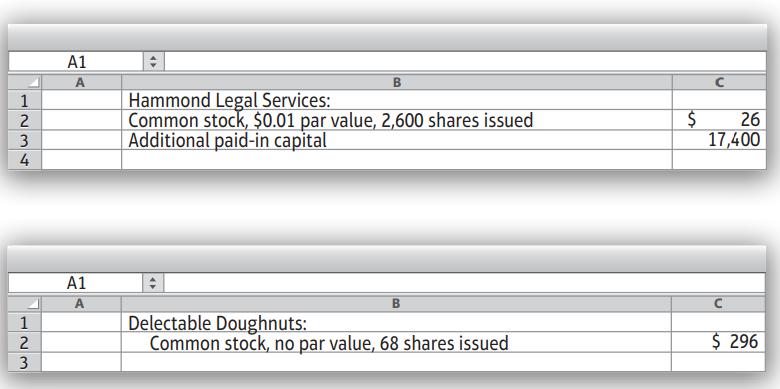

At the end of fiscal year 2021, Hammond Legal Services and Delectable Doughnuts reported these adapted amounts on their balance sheets (all amounts in millions except for par value per share):

Assume each company issued its stock in a single transaction. Journalize each company’s issuance of its stock, using its actual account titles. Explanations are not required.

Transcribed Image Text:

123 4 1 2 3 4 1 2 23 3 A1 A A1 A Hammond Legal Services: Common stock, $0.01 par value, 2,600 shares issued Additional paid-in capital Delectable Doughnuts: Common stock, no par value, 68 shares issued $ 26 17,400 $ 296

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 61% (13 reviews)

Hammond Legal Services Cash ...View the full answer

Answered By

Sumit kumar

Education details:

QUATERNARY Pursuing M.Tech.(2017-2019) in Electronics and Communication Engg. (VLSI DESIGN) from

GNIOT Greater Noida

TERTIARY B.Tech. (2012-2016) in Electronics and Communication Engg. from GLBITM Greater Noida

SECONDARY Senior Secondary School Examination (Class XII) in 2012 from R.S.S.Inter College, Noida

ELEMENTARY Secondary School Examination (Class X) in 2010 from New R.J.C. Public School ,Noida

CERTIFICATION

Summer Training in ‘WIRELESS EMBEDDED SYSTEM’ from ‘XIONEE’ for the six weeks.

EMBEDDED SYSTEM Certificate issued by CETPA INFOTECH for one day workshop.

Certificate of Faculty development program on OPTICAL COMMUNICATION and NETWORKS for one week.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

At the end of fiscal year 2018, Hammond Legal Services and Delectable Doughnuts reported these adapted amounts on their balance sheets (all amounts in millions except for par value per share): Assume...

-

At the end of fiscal year 2012 (September 30, 2012), the U.S. government owed $16.2 trillion. Who owns that debt? The following table lists the amounts owed as of September 30, 2012. Use a graphical...

-

The Hewlett-Packard Company issued zero-coupon notes at the end of its 1997 fiscal year that mature at the end of its 2017 fiscal year. One billion, eight hundred million dollars face amount of...

-

The following information is available for HTM Corporation's defined benefit pension plan: On January 1, 2017, HTM Corp. amended its pension plan, resulting in past service costs with a present value...

-

From street level, Superman spots Lois Lane in trouble the evil villain, Lex Luthor, is dropping her from near the top of the Empire State Building. At that very instant, the Man of Steel starts...

-

From the qualifying information, a salesperson might determine that an aircraft would be a decided as- set to a firm. T F

-

3. Fund-raising costs of voluntary health and welfare organizations are classified as: a Functional expenses b Program services c Supporting services d Management and general expenses Accounting for...

-

The ABC Corporation is designing its new assembly line. The line will produce 50 units per hour. The tasks, their times, and their immediate predecessors are shown in Table 10-19. (a) Which task is...

-

Each year for your anniversary, beginning with the first one, you put 300.00 away earning 7%. How much would you have if you started the day you were married and you were married for 11 years

-

The trial balance of Lindor Limited as at 31 March 2023 was as follows: Administration expenses Distribution expenses Directors fees Bad debts Audit fees Trade receivables and trade payables...

-

Identify the current liability associated with each of the following operating activities: 1. Perform work on a warranty claim 2. Pay income taxes 3. Purchase supplies 4. Pay payroll taxes 5. Borrow...

-

The Princeville Company has debt covenants on its bank loan. During the 15-year term of the loan, Princeville must comply with these covenants: a. Current ratio must be 1.25 or higher. b. Debt ratio...

-

List some examples of common rewards offered to cardholders.

-

Sunland Corp. exchanged Building 24, which has an appraised value of $1,815,000, a cost of $2,842,000, and accumulated depreciation of $1,272,000, for Building M which belongs to Oriole Ltd. Building...

-

Conlon Chemicals manufactures paint thinner. Information on the work in process follows: -Beginning Inventory, 43,000 partially complete gallons -Transferred out, 211300 gallons -Ending inventory...

-

Mr . Nikola Tesla launched Tesla Supermart on December 1 , 2 0 x 1 with a cash investment of 1 5 0 , 0 0 0 . The following are additional transactions for the month: 2 Equipment valued at 2 0 , 0...

-

The Robots: Stealing Our Jobs or Solving Labour Shortages? As the coronavirus pandemic enveloped the world, businesses increasingly turned to automation in order to address rapidly changing...

-

Aquazona Pool Company is a custom pool builder. The company recently completed a pool for the Drayna family ( Job 1 3 2 4 ) as summarized on the incomplete job cost sheet below. Assume the company...

-

Which of the vectors in Figure P1.49 have approximately the same direction? Figure P1.49 ? (a). L(b) (c)_ (d). (e) (f) (g) (h)

-

Define a traverse in Surveying?

-

An inexperienced accountant for Corfeld Corporation showed the following in Corfelds 2012 income statement: Income before income taxes $300,000; Income tax expense $72,000; Extraordinary loss from...

-

On January 1, 2012, Gustin Inc. changed from the LIFO method of inventory pricing to the FIFO method. Explain how this change in accounting principle should be treated in the companys financial...

-

Using these data from the comparative balance sheet of Rosalez Company, perform horizontalanalysis. December 31, 2012 $ 460,000 December 31, 2011 $ 400,000 Accounts receivable Inventory 3,164,000...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App