Regan Corporation reported the following amounts on its 2021 comparative income statements: Perform a horizontal analysis of

Question:

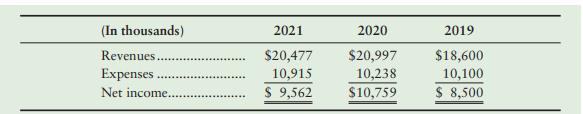

Regan Corporation reported the following amounts on its 2021 comparative income statements:

Perform a horizontal analysis of revenues, expenses, and net income—both in dollar amounts and in percentages—for 2021 and 2020.

Transcribed Image Text:

(In thousands) Revenues. Expenses. Net income.. 2021 $20,477 10,915 $ 9,562 2020 $20,997 10,238 $10,759 2019 $18,600 10,100 $ 8,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

Dollars in thousands 2020 2019 20997 18600 10...View the full answer

Answered By

Nimlord Kingori

2023 is my 7th year in academic writing, I have grown to be that tutor who will help raise your grade and better your GPA. At a fraction of the cost on other sites, I will work on your assignment by taking it as mine. I give it all the attention it deserves and ensures you get the grade that I promise. I am well versed in business-related subjects, information technology, Nursing, history, poetry, and statistics. Some software's that I have access to are SPSS and NVIVO. I kindly encourage you to try me; I may be all that you have been seeking, thank you.

4.90+

360+ Reviews

1070+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Fitzgerald Corporation reported the following amounts on its 2010 comparative income statement: Perform a horizontal analysis of revenues and net income both in dollar amounts and in percentages for...

-

Webby Corporation reported the following amounts on its income statement: service revenues, $32,500; utilities expense, $300; net income, $1,600; and income tax expense, $900. If the only other...

-

Verifine Corporation reported the following amounts on its 2012 comparative income statements: Perform a horizontal analysis of revenues and net incomeboth in dollar amounts and in percentagesfor...

-

Start your VM and open a terminal window (note: you may always open more than one terminal window if desired). For this laboratory exam, we will be using the network topology shown in Figure 1....

-

For each of the given vectors, give a vector that, when added to it, yields a null vector (a vector with a magnitude of zero). Express the vector in the form other than that in which it is given...

-

Patton Company charges all of its departments and manufacturing cells for the use of engineering services. Budgeted engineering costs for the year are $160,000, and budgeted engineering hours are...

-

4. For nongovernmental NFP, explain the difference between a conditional promise to give and an unconditional promise to give. Accounting for Not-for-Profit Organizations 765

-

Futura Company purchases the 40,000 starters that it installs in its standard line of farm tractors from a supplier for the price of $8.40 per unit. Due to a reduction in output, the company now has...

-

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company s financial statements,...

-

Corus Entertainment Inc. is a Canadian integrated media and entertainment company that delivers engaging, interactive, and informative content to millions of people every day. Its television services...

-

The Metro 2021 income statement follows. Use the preceding income statement and the balance sheet from S12-6 to calculate the following: a. Metros rate of inventory turnover and days inventory...

-

The 2021 income statement and the 2021 comparative balance sheet of Ghent River Camp, Inc., have just been distributed at a meeting of the camps board of directors. The directors raise a fundamental...

-

The IRS audited Tonys return, and Tony agreed to pay additional taxes plus the negligence penalty. Is this penalty necessarily imposed on the total additional taxes that Tony owes? Explain.

-

Lennys Limousine Service (LLS) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Required: Help LLS evaluate this project by calculating...

-

Lancer Corp. has the following information available about a potential capital investment Required: 1. Calculate the projects net present value. 2. Without making any calculations, determine whether...

-

Woodchuck Corp. is considering the possibility of outsourcing the production of upholstered chair pads included with some of its wooden chairs. The company has received a bid from Padalong Co. to...

-

Woodchuck Corp. is considering eliminating a product from its line of outdoor tables. Two products, the Oak-A and Fiesta tables, have impressive sales. However, sales for the Studio model have been...

-

Suppose that Flyaway Company also produces the Windy model fan, which currently has a net loss of \($40,000\) as follows: Eliminating the Windy product line would eliminate \($20,000\) of direct...

-

What are standards? How are they different from policy?

-

Currently, there are five concepts of food stands, including: hot dogs, soft pretzels, turkey legs, sandwich wraps, and funnel cakes. This approach will double the existing number of food stands...

-

Using the data in BE4-6, journalize and post the entry on July 1 and the adjusting entry on December 31 for Craig Insurance Co. Craig uses the accounts Unearned Service Revenue and Service Revenue.

-

The bookkeeper for Forseth Company asks you to prepare the following accrual adjusting entries at December 31. (a) Interest on notes payable of $300 is accrued. (b) Service revenue earned but...

-

The trial balance of LaGrace Company includes the following balance sheet accounts. Identify the accounts that might require adjustment. For each account that requires adjustment, indicate (1) The...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App