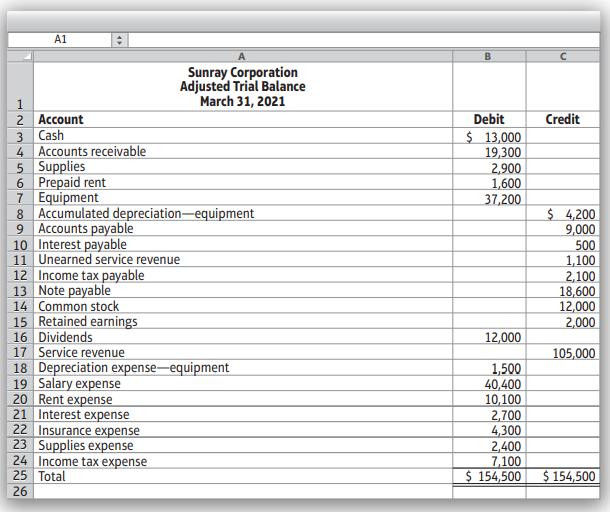

The adjusted trial balance for the year of Sunray Corporation at March 31, 2021, follows. Requirements 1.

Question:

The adjusted trial balance for the year of Sunray Corporation at March 31, 2021, follows.

Requirements

1. Prepare Sunray Corporation’s 2021 single-step income statement, statement of retained earnings, and balance sheet. Draw arrows linking the three financial statements.

2. Sunray’s lenders require that the company maintain a debt ratio no higher than 0.50. Calculate Sunray’s debt ratio at March 31, 2021, to determine whether the company is in compliance with this debt restriction. If not, suggest a way that Sunray could have avoided this difficult situation.

A1 Sunray Corporation Adjusted Trial Balance March 31, 2021 2 Account 3 Cash 4 Accounts receivable 5 Supplies 6 Prepaid rent 7 Equipment 8 Accumulated depreciation-equipment 9 Accounts payable 10 Interest payable 11 Unearned service revenue 12 Income tax payable 13 Note payable 14 Common stock 15 Retained earnings 16 Dividends 17 Service revenue 18 Depreciation expense-equipment 19 Salary expense 20 Rent expense 21 Interest expense 22 Insurance expense 23 Supplies expense 24 Income tax expense 25 Total 26 Debit $ 13,000 19,300 2,900 1,600 37,200 Credit $ 4,200 9,000 500 1,100 2,100 18,600 12,000 2,000 12,000 1,500 40,400 10,100 2,700 4,300 2,400 7,100 $ 154,500 $ 154,500 105,000

Step by Step Answer:

Req 1 Req 2 Sunray is in compliance with its debt agreement which ...View the full answer

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance for the year of Sunray Corporation at March 31, 2018, follows. Requirements 1. Prepare Sunray Corporations 2018 single-step income statement, statement of retained...

-

The adjusted trial balance for the year of Scneider Corporation at December 31, 2016, follows: Requirements 1. Prepare Schneider Corporation's 2016 single-step income statement, statement of retained...

-

The adjusted trial balance for Sundance Marketing Co. follows. Complete the four right-most columns of the table by first entering information for the four closing entries (keyed 1 through 4) and...

-

In Problems 11 54, simplify each expression. Assume that all variables are positive when they appear. 2 ( 5 29 )

-

Restate persuasively each of the following issues. Each issue should be redrafted twicepersuasively from the view of the opposing sides. A. Under the provisions of the exclusionary rule, should...

-

Explain revenue control procedures for food servers and beverage personnel. (pp. 267-270)

-

Continue the example in the text, where the fitness is determined by the Normal (16, 4) distribution. Proceed to the end of the third iteration. Suppress mutation, and perform crossover only once, on...

-

(Multiple Choice) The Plaza Company originated late in 2006 and began operations on January 2, 2007. Plaza is engaged in conducting market research studies on behalf of manufacturers. Prior to the...

-

can anyone help me figure C. out. the table he wants us to create is suppose to look like ex. 9.16 (pic. 3) heres additional information just incase you need it. C. The company decides to compute...

-

Sandra?s Purse Boutique has the following transactions related to its top-selling Gucci purse for the month of October. Required: 1. Calculate ending inventory and cost of goods sold at October 31,...

-

The accounts of Meadowbrook Service, Inc., at January 31, 2021, are listed in alphabetical order. Requirements 1. All adjustments have been journalized and posted, but the closing entries have not...

-

Fairmount Co. prepaid three years rent ($31,500) on January 1, 2021. At December 31, 2021, Fairmount prepared a trial balance and then made the necessary adjusting entry at the end of the year....

-

The following trial balance was extracted from the books of Tim Russell at 31 December 20X0. The following additional information as at 31 December 20X0 is available: 1 588 of the carriage represents...

-

Management is what tradition used to call a liberal art: "liberal" because it deals with the fundamentals of knowledge, self-knowledge, wisdom, and leadership; "art" because it is a practice and...

-

Draft a five hundred and twenty five- to seven hundred-word internal communication planthat appropriately details your proposed solution to the internal team at CVS PHARMACY. In your communication...

-

Christopher Awnings was founded by Christopher Aminim in the early days of the retirement boom in the Okanagan to build and install custom retractable awnings for retirees to keep the sun out of the...

-

Leaders are responsible for making decisions that have long-term ramifications; thus, making the appropriate decisions can be stressful and leaders' decisions may vary. They often enhance employee...

-

Employee longevity A large insurance company has developed a model to identify the factors associated with employee turnover. The dependent variable is number of years an employee stays with the...

-

Use the given graph of f to sketch the graph of f 1 . 2.

-

Suppose the index goes to 18 percent in year 5. What is the effective cost of the unrestricted ARM?

-

From the following list of steps in the accounting cycle, identify what two steps are missing. a. Transactions are analyzed and recorded in the journal. b. An unadjusted trial balance is prepared. c....

-

From the following list of steps in the accounting cycle, identify what two steps are missing. a. Transactions are analyzed and recorded in the journal. b. An unadjusted trial balance is prepared. c....

-

Balances for each of the following accounts appear in an adjusted trial balance. Identify each as (a) Asset, (b) Liability, (c) Revenue, or (d) Expense. 1. Accounts Payable 2. Equipment 3. Fees...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

Study smarter with the SolutionInn App