JED Capital Inc. makes investments in trading securities. Selected income statement and balance sheet items for the

Question:

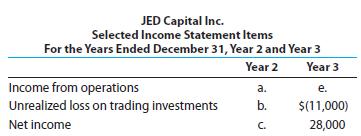

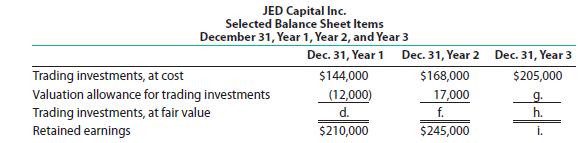

JED Capital Inc. makes investments in trading securities. Selected income statement and balance sheet items for the years ended December 31, Year 2 and Year 3, are as follows:

Determine the missing lettered items assuming JED Capital Inc. paid no dividends.

Transcribed Image Text:

JED Capital Inc. Selected Income Statement Items For the Years Ended December 31, Year 2 and Year 3 Year 2 Year 3 Income from operations Unrealized loss on trading investments a. е. b. $(11,000) Net income C. 28,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

a Trading investments at cost 144000 The trading investments at cost for Dec 31 Year 1 is provided i...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 9781337913102

16th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider

Question Posted:

Students also viewed these Business questions

-

Dividends are recognized in profit or loss only when: a. the entity's right to receive payment of the dividend is established; D. it is probable that the economic benefits associated with the...

-

Selected income statement and balance sheet data from Merck & Co. f0or Year 9 are reproduced below: MERCK & COMPANY, INC. Year 9 Selected Financial Data ($ millions) Income Statement Data Sales...

-

JED Capital Inc. makes investments in trading securities. Selected income statement items for the years ended December 31, 2016 and 2017, plus selected items from comparative balance sheets, are as...

-

"Assault on college campuses can no longer remain just a female issue, and universities nationwide must prepare males for the same protections it provides their female counterparts in college Title...

-

Unions can affect (a) A firms profits, (b) The price consumers pay for a good, and (c) The wages received by non-union workers. Do you agree or disagree? Explain your answer.

-

You are the audit manager in the audit of the financial statements of Midwest Grain Storage, Inc., a new client. The companys records show that, as of the balance sheet date, approximately 15 million...

-

26. Marcus is the CEO of publicly traded ABC Corporation and earns a salary of $1,500,000. What is ABCs after-tax cost of paying Marcuss salary?

-

Keystone Computer Timeshare Company entered into the following transactions during May 2015. 1. Purchased computer terminals for $20,000 from Data Equipment on account. 2. Paid $3,000 cash for May...

-

Question 5 (4 points) I saved The proper journal entry to purchase a computer costine $975 on account to be utilized for 5 years in the business would be 975 Office Supplies Accounts Payable 975 975...

-

1. How do information technologies contribute to the business success of Sew What? Inc.? Give several examples from the case regarding the business value of information technology that demonstrate...

-

On January 23, 15,000 shares of Aurora Companys common stock are acquired at a price of $25 per share plus a $150 brokerage commission. On April 12, a $0.50-per-share dividend was received on the...

-

You hold a 25% common stock interest in YouOwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of...

-

Read the Coca-Cola Companys Annual Report (most recent one) and calculate the various financial ratios defined in Figure 2.7. Then give your assessment of the companys general financial condiLion...

-

Archer Contracting repaved 50 miles of two-lane county roadway with a crew of six employees. This crew worked 8 days and used \($7,000\) worth of paving material. Nearby, Bronson Construction repaved...

-

An insurance company has the following profitability analysis of its services: The fixed costs are distributed equally among the services and are not avoidable if one of the services is dropped. What...

-

The Scantron Company makes bar-code scanners for major supermarkets. The sales staff estimates that the company will sell 500 units next year for 10,000 each. The production manager estimates that...

-

Determine the following: a. The stockholders equity of a company that has assets of \(\$ 625,000\) and liabilities of \(\$ 310,000\). b. The retained earnings of a company that has assets of \(\$...

-

You are the manager of internal audit for Do-It-All, Ltd., a large, diversified, decentralized manufacturing company. Over the past two years, the information systems function in Do-It-All has...

-

On January 1, 2022, Bryce Inc. changed from the LIFO method of inventory pricing to the FIFO method. Explain how this change in accounting principle should be treated in the companys financial...

-

When is the indirect pattern appropriate, and what are the benefits of using it?

-

Assume the following data for Oshkosh Company before its year-end adjustments: Sales...

-

From the following list, identify the accounts that should be closed to Tim Button, Capital at the end of the fiscal year under a perpetual inventory system: (a) Accounts Receivable (b) Cost of...

-

Based on the data presented in Exercise 6-25, journalize the closing entries. Data from Exercise 6-25, On March 31, 20Y4, the balances of the accounts appearing in the ledger of Racine Furnishings...

-

Q1) The equity of Washington Ltd at 1 July 2020 consisted of: Share capital 500 000 A ordinary shares fully paid $1 500 000 400 000 B ordinary shares issued for $2 and paid to $1.50 600 000 General...

-

out The following information relates to Questions 1 to 2. The management accountant of a furniture manufacturer is developing a standard for the labour cost of one massage chair. When operating at...

-

Exercise 10-8 Utilization of a constrained Resource [LO10-5, L010-6] Barlow Company manufactures three products: A, B, and C. The selling price, variable costs, and contribution margin for one unit...

Study smarter with the SolutionInn App