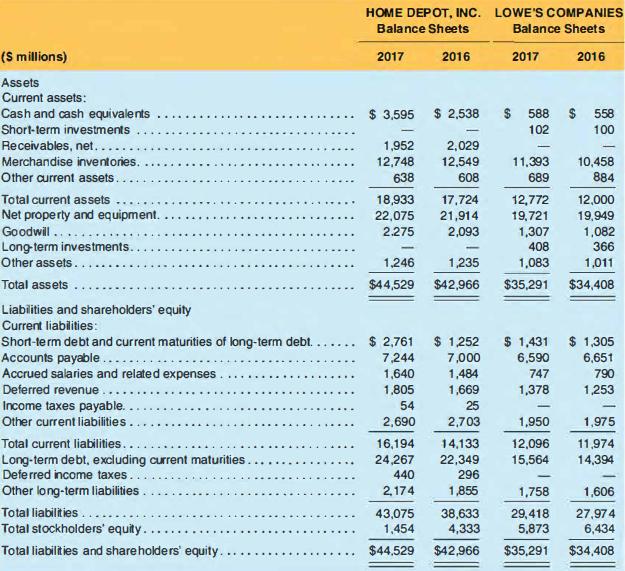

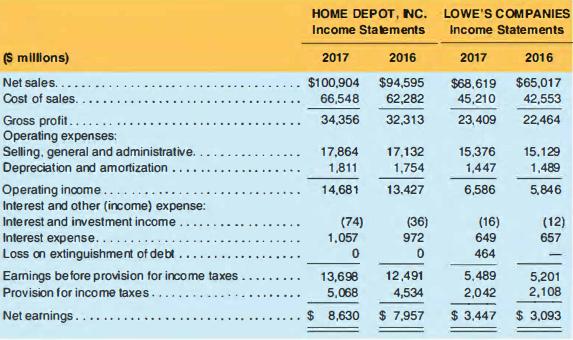

Balance sheets and income statements for The Home Depot, Inc., and Lowe's Companies, Inc., follow. Refer to

Question:

Balance sheets and income statements for The Home Depot, Inc., and Lowe's Companies, Inc., follow. Refer to these financial statements to answer the requirements.

REQUIRED:

a. Compute return on equity (ROE). return on assets (ROA), and return on financial leverage ( ROFL) for each company in fiscal year 2017. Assume a tax rate of 35% for these year,.

b. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company?

c. Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companies' profitability measures compare?

d. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies' turnover measures compare?

e. Compare and evaluate these competitors' performance in 2017.

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman