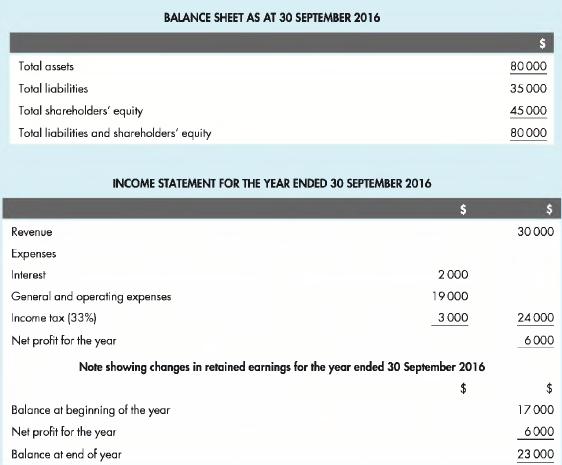

Company A is 100 percent owned by Mr A. The summary of Company A's financial statement

Question:

Company A is 100 percent owned by Mr A. The summary of Company A's financial statement information is as follows:

1. Calculate Company A's return on equity for 2016.

2. Company A is considering borrowing $50 000 for additional assets that would earn the company the same return on assets it has historically earned, according to the financial statement information above. The cost of borrowing this money is 8 percent. Should the company borrow the money? (Assume there are no alternative sources of funding.) Show all calculations.

3. Place yourself in the role of the local bank manager. Mr A has approached you to lend the company the required $50 000 mentioned above. (Detailed financial statement information has already been presented to you.) What additional information would you require, if any? What financial statement ratios, in addition to those calculated in previous parts of this problem, would be useful in aiding your decision? Do not calculate the ratios; just mention or describe them.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson