Comparative balance sheets and income statements for Stradbroke Ltd are given below. During 2016, Stradbroke Ltd declared

Question:

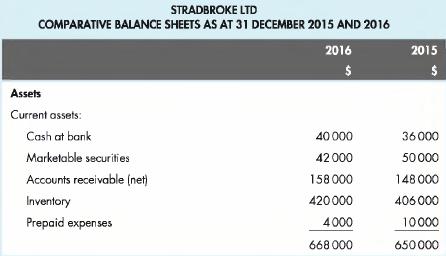

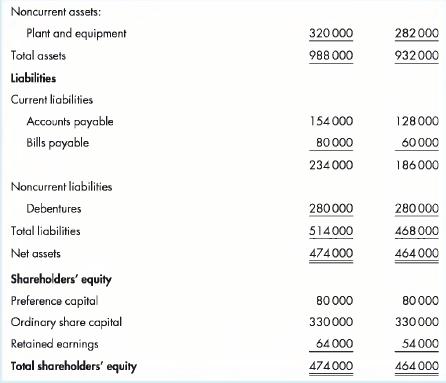

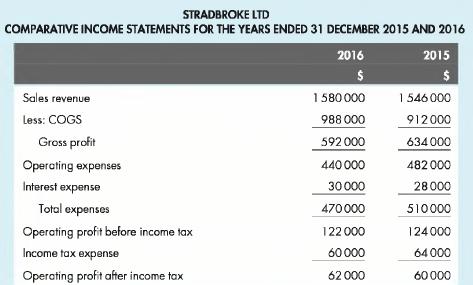

Comparative balance sheets and income statements for Stradbroke Ltd are given below.

During 2016, Stradbroke Ltd declared and paid preference dividends of $5600 and ordinary dividends of $46400. On 31 December 2016, the market price per ordinary share was $5.40.

1. Assume you are a banker evaluating a request for a short-term loan from Stradbroke Ltd. The company would like to borrow on 1 January 2016, with repayment on 30 June 2016. Name and calculate three 2016 ratios that you would use to determine the likelihood that the company will be able to make the loan repayment when it falls due.

2. Assume you are a potential investor evaluating a share purchase in Stradbroke Ltd. You are looking for an investment that will provide a steady stream of dividend income over the years. Name and calculate three 2016 ratios that you would use to make your decision about whether to buy shares in Stradbroke Ltd.

3. List and briefly explain three disadvantages of basing your decisions solely on ratio analysis.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson