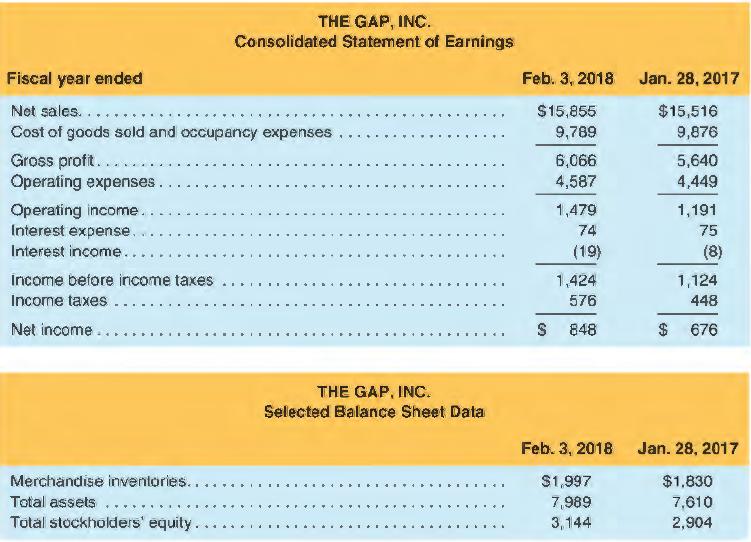

Income statements for The Gap, Inc., follow, along with selected balance sheet information ($ millions). a. Compute

Question:

Income statements for The Gap, Inc., follow, along with selected balance sheet information ($ millions).

a. Compute the return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for the fiscal year ended February 3, 2018. Assume an incremental tax rate of 35%.

b. Disaggregate ROA into profit margin (PM) and asset turnover (AT).

c. Compute the gross profit margin (GPM) and inventory turnover (INVT) ratios for the fiscal year ended February 3, 2018.

d. Assess the Gap's performance. What are the most important drivers of the Gap's success?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman

Question Posted: