Selected data from recent financial statements of The Procter & Gamble Company, CVS Health Corporation, and Valero

Question:

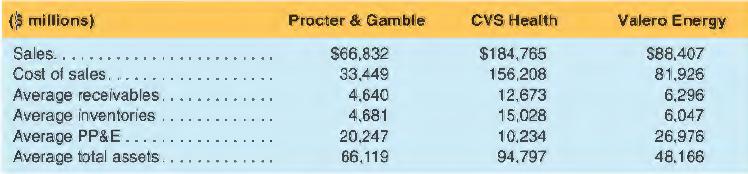

Selected data from recent financial statements of The Procter & Gamble Company, CVS Health Corporation, and Valero Energy Corporation are presented below:

a. Compute the asset turnover (AT) ratio for each company.

b. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and PP&E turnover (PPET) for each company.

c. Discuss any differences across these three companies in the turnover ratios computed in a and b.

(3 millions) Procter & Gamble CVS Health Valero Energy Sales..... Cost of sales. Average receivables.. Average inventories. Average PP&E.... Average total assets. S66,832 $184,765 156,208 S88.407 81,926 33,449 4.640 12,673 6,296 4,681 15,028 6,047 20.247 10,234 26,976 66,119 94,797 48.166 .... ..

Step by Step Answer:

a b c For all three companies these ratios reflect differences in their businesses and the overal...View the full answer

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman

Related Video

Inventory turnover is a key metric that helps businesses evaluate the efficiency of their operations. A high turnover ratio is generally considered positive, indicating that the company is effectively selling its inventory and making efficient use of its resources. On the other hand, a low turnover ratio may indicate issues such as overstocking or slow sales and may require further examination to identify and address the underlying causes. Businesses use this ratio to make decisions about inventory levels, production schedules, and pricing strategies. It also helps businesses to identify areas where they may need to make improvements, such as reducing lead times for production or optimizing sales and marketing efforts. Additionally, inventory turnover is used by investors and analysts as a key performance indicator to evaluate the financial health and growth potential of a company.

Students also viewed these Business questions

-

Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for...

-

The following information was available from recent financial statements of Papa John's Pizza: Required Calculate and interpret (1) Horizontal and vertical analyses of fixed assets and depreciation...

-

The following data are taken from recent financial statements of Nike, Inc. (NKE) (in millions): a. Determine the amount of change (in millions) and percent of change in operating income from Year 1...

-

Let V be the volume of a can of radius r and height h, and let S be its surface area (including the top and bottom). Find r and h that minimize S subject to the constraint V = 54.

-

Nitrogen gas, N2, is heated to 4000 K, 10 kPa. What fraction of the N2 is dissociated to N at this state?

-

Your company has been approached to bid on the contract to sell 17,500 voice recognition (VR) computer keyboards a year for four years. Due to technological improvements, beyond that time they will...

-

1. Summarize reasons for conducting an orientation for new employees.

-

Lohn Corporation is expected to pay the following dividends over the next four years: $10, $7, $6, and $2.75. Afterwards, the company pledges to maintain a constant 5 percent growth rate in dividends...

-

Duffy Dog Corporation started the year ended November 30, 2021, with 197,000 common shares and no preferred shares issued. The following changes in share capital occurred during the year: Feb. 28...

-

Open the Orders Solution.sln file contained in the VB2017Chap03Orders Solution folder. The interface provides a button for adding the number ordered to the total ordered, and a button for subtracting...

-

Selected balance sheet and income statement information from Verizon Communications, Inc .. follows. a. Compute the current ratio for each year and discuss any change in liquidity. How does Verizon...

-

Selected balance sheet and income statement information from Urban Outfitters, Inc. and TJX Companies, clothing retailers in the high-end and value-priced segments, respectively, follows. a. Compute...

-

Miller Corporation is considering replacing a machine. The replacement will reduce operating expenses (that is, increase earnings before depreciation, interest, and taxes) by $16,000 per year for...

-

Q1. (a) Name the types of reactions that organic compounds undergo (b) Differentiate between (i) electrophile and nucleophile

-

CH4 Br, Ligtht Q2. (a) CH3Br + HBr Propose a mechanism for the reaction; indicating initiation, propagation and termination.

-

Q4. Complete the following reactions by drawing the structure(s) of the product(s) formed.

-

1. Why did the Iconoclast emperors believe that using images in worship was wrong? 2. How are recent examples of iconoclasm similar to those of the early medieval period? 3. Why is iconoclasm a...

-

1. Difference Between Essential and Non-Essential Nutrients 2. what is Conditionally Essential Nutrients? explain with examples

-

What is program budgeting? Based on the Real Life titled The benefits of program budgeting in the section Program budgeting, identify some of the advantages of program budgeting. How does it differ...

-

Fill in each blank so that the resulting statement is true. A solution to a system of linear equations in two variables is an ordered pair that__________ .

-

Explain each of these important terms in issuing bonds: (a) Face value. (b) Contractual interest rate. (c) Bond certificate.

-

(a) What is a convertible bond? (b) Discuss the advantages of a convertible bond from the standpoint of the bondholders and of the issuing corporation.

-

Phil and Mason are discussing how the market price of a bond is determined. Phil believes that the market price of a bond is solely a function of the amount of the principal payment at the end of the...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App