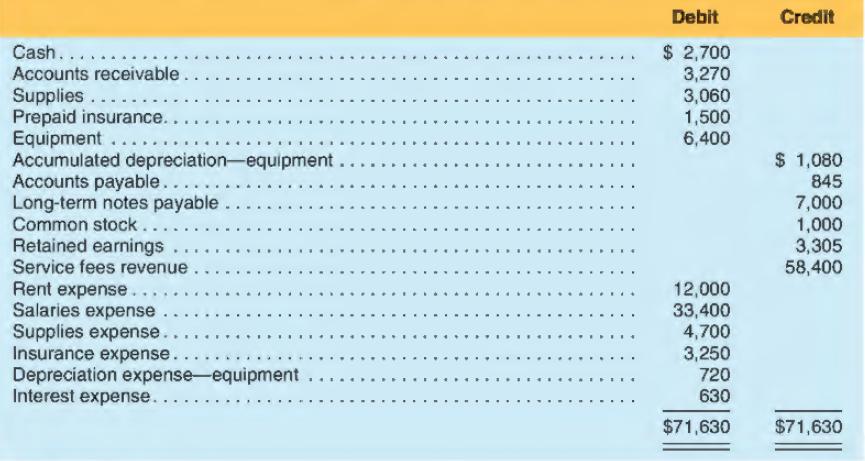

The following adjusted trial balance is for True man Consulting Inc. at December 31, 2018. The company

Question:

The following adjusted trial balance is for True man Consulting Inc. at December 31, 2018. The company had no stock issuances or repurchases during 2018.

REQUIRED

a. Prepare its income statement and statement of stockholders' equity for 2018 and its balance sheet at December 31, 2018.

b. Prepare entries to close its accounts in journal entry form.

Debit Credit Cash..... Accounts receivable Supplies .... Prepaid insurance. Equipment .... Accumulated depreciation-equipment Accounts payable.... . . Long-term notes payable Common stock... Retained earnings Service fees revenue.... Rent expense.. Salaries expense Supplies expense. Insurance expense. Depreciation expense-equipment Interest expense.. $ 2,700 3,270 3,060 1,500 6,400 ... $ 1,080 845 .... 7,000 1,000 3,305 58,400 12,000 33,400 4,700 3,250 720 .... 630 $71,630 $71,630

Step by Step Answer:

a b Revenue Service fees Expenses Rent expense Salaries e...View the full answer

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The following adjusted trial balance of Schneider Consulting, Inc. was prepared for the year ended December 31, 2009. Required: (a) Prepare an income statement for the year ended December 31, 2009....

-

The Sky Blue Corporation has the following adjusted trial balance at December 31. Prepare an income statement for the year ended December 31. How much net income did the Sky Blue Corporation generate...

-

The following adjusted trial balance for Bell Servicing was prepared at the end of the fiscal year, December 31, 2014: Required 1. Prepare a classified multiple-step income statement that would be...

-

A mover lifts a 50 lbm box off the ground and places it on a truck (Figure 1-21). If the floor of the truck is 4 feet off the ground, how much work was required to lift the box? 4 ft 50 lbs...

-

Update the time series of producer prices of oranges in Florida in Figure 5.3 and download a similar series for California (www.usda.gov). Calculate the autocorrelation functions for both California...

-

Given the accounting equation, answer each of the following questions. 1. The liabilities of Franks Smoothies are $120,000, and the stockholders equity is $325,000. What is the amount of Franks total...

-

Develop and apply group facilitation skills to make meetings more productive and satisfying. lop5

-

Caramel Corporation has 5,000 shares of stock outstanding. In a qualifying stock redemption, Caramel distributes $145,000 in exchange for 1,000 of its shares. At the time of the redemption, Caramel...

-

Explain how each would be treated in the financial statements and state the total amount to be reported as an accrued liability on the balance sheet date. The year-end is 31 December Year 1. Amount $...

-

Abbott Corporation does not conduct a complete annual physical count of purchased parts and supplies in its principal warehouse but instead uses statistical sampling to estimate the year- end...

-

The following information relates to the December 31 adjustments for Kwik Print Company. The firm's fiscal year ends on December 31. 1. Weekly employee salaries for a five-day week total $ 1,800,...

-

The following adjusted trial balance is for Wilson Company at December 31, 2018. REQUIRED: a. Prepare closing entries in journal entry form. b. After the firm's closing entries are posted, what is...

-

Using the information from Problem 4-54, allocate the costs using the step-down method, but change the order of step-down from that used when you solved Problem 4-55. Do your results differ from...

-

Notation Using the weights (Ib) and highway fuel consumption amounts (mi/gal) of the 48 cars listed in Data Set 35 "Car Data" of Appendix B, we get this regression equation: = 58.9 - 0.00749x, where...

-

Week 11-Final Exam: Chapters 5-7 Question 15 of 30 -135 Current At in Ppm 06-20 10%.onthe 1110077 OORE Textbook and M DOLL F T 19 19 Q w A R T Y 3 . 9 4 S D 4 G H A L x N M Cu T

-

We have two samples: sample 1 n= 39 -X= 98.2 S= 15.9 sample 2 n=31 -X=119.2 S= 23.0 begin testing whether u1

-

Discuss charitable purpose trusts under Section 3(1), Charities Act 2011.

-

Amadeus Corporation is considering the issue of a new product to be added to its product mix. They hired you, a recent business graduate from MacEwan, for conducting the analysis. The production line...

-

If the correlation between two explanatory variables is high, the least-squares regression model may suffer from _________________.

-

Distinguish between the work performed by public accountants and the work performed by accountants in commerce and industry and in not-for-profit organisations.

-

Holding all other factors constant, indicate whether each of the following changes generally signals good or bad news about a company. (a) Increase in profit margin. (b) Decrease in inventory...

-

Indicate whether each of the following statements is true or false. 1. The corporation is an entity separate and distinct from its owners. 2. The liability of stockholders is normally limited to...

-

Accounting is ingrained in our society and it is vital to our economic system. Do you agree? Explain.

-

Aecerty 1067687 was completed with the folowing charaderistick Murulectere sec00 5xs:99 s35ida sputed

-

Assume todays settlement price on a CME EUR futures contract is $1.3180 per euro. You have a long position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond...

-

Q2. Company ABC bought an equipment for $20,000 in 2015, with useful life of 5 years $5,000 residual value amortized using straight-line method. Prepare a table to illustrate the differences...

Study smarter with the SolutionInn App