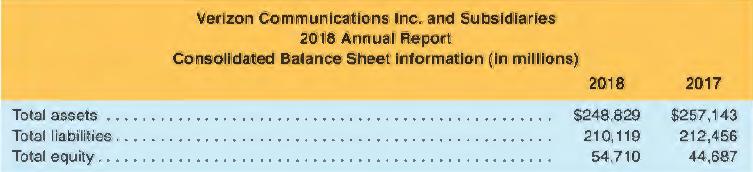

Verizon Communications Inc. provides the following balance sheet (excerpted and abbreviated) and discussion and disclosure of leases:

Question:

Verizon Communications Inc. provides the following balance sheet (excerpted and abbreviated) and discussion and disclosure of leases:

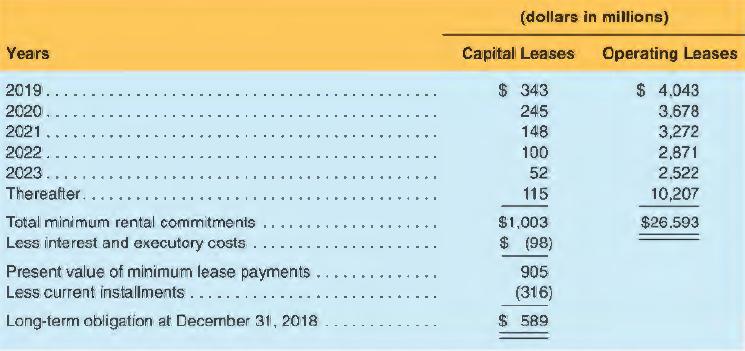

The aggregate minimum rental commitments under noncancelable leases for the periods shown at December 31, 2018, are as follows:

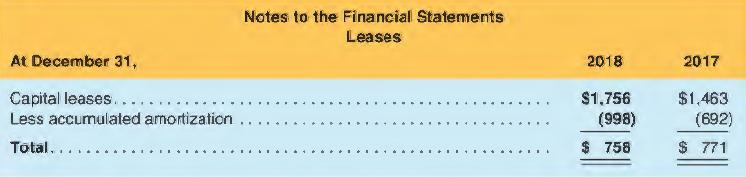

The company also discloses the following in the summary of significant accounting policies:

In February 2016, the FASB issued this standard update to increase transparency and improve comparability by requiring entities to recognize assets and liabilities on the balance sheet for all leases, with certain exceptions. In addition, through improved disclosure requirements, the standard update will enable users of financial statements to further understand the amount, timing, and uncertainty of cash flows arising from leases. Upon adoption of this standard, there will be a significant impact in our consolidated balance sheet as we expect to recognize a right-of-use asset and liability related to substantially all operating lease arrangements, which we currently estimate will range between $21.0 billion and $23.0 billion. Verizon's current operating lease portfolio included in this range is primarily comprised of network equipment including towers, distributed antenna systems, and small cells, real estate, connectivity mediums including dark fiber, and equipment leases.

a. As of the end of 2018, what amount of assets are included on the balance sheet with respect to leases? What amount of liabilities?

b. What amount does Verizon state they need to add to the balance sheet as a right-of-use asset for operating leases and a lease liability for operating leases?

c. If Verizon would have adopted the new lease standard on December 31, 2018, and had determined that the right-of-use lease asset for operating leases and the liability amount were both $22 billion, how would the company's debt-to-equity ratio change? Assume no other changes on the balance sheet.

d. What do you predict will happen to ratios such as return-on-assets using reported numbers for both before and after the new standard is adopted?

Step by Step Answer:

Financial Accounting

ISBN: 9781618533111

6th Edition

Authors: Michelle L. Hanlon, Robert P. Magee, Glenn M. Pfeiffer, Thomas R. Dyckman