Question:

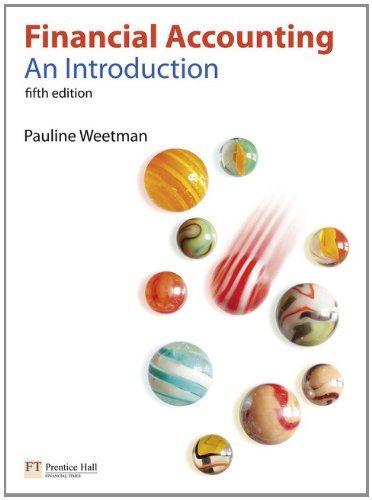

2 What major ratios are not shown in this summary?

Transcribed Image Text:

IFRS IFRS IFRS IFRS IFRS 2009 2008 2007* 2006 2005 '000 '000 '000 '000 '000 Consolidated income statement Revenue 214,805 208,122 185,989 176,626 187,704 Operating profit 9,740 10,326 8,852 7,307 10,445 Net finance costs (1,652) (1,856) (1,771) (2,142) (2,366) Profit before taxation 8,088 8,470 7,081 5,165 8,079 Taxation (4,483) (2,402) (1,785) (1,517) (2,529) Profit attributable to equity shareholders 3,605 6,068 5,296 3,648 5,550 Balance sheet Net assets 27,738 35,035 34,886 31,954 31,575 Net borrowings (18,612) (19,912) (16,142) (15,998) (18,063) Net debt (26,674) (28,264) (26,411) (27,571) (28,391) Gearing ratio 92.8% 80.7% 75.7% 86.3% 89.9% Additions to intangible assets and property, plant 10,243 7,905 7,938 7,513 11,204 and equipment Other financial data Basic earnings per share (excluding exceptional items) 6.5p 9.1p. 8.0p 6.4p 10.3p Dividends per share 6.1p 6.8p 6.8p 6.8p 6.8p Number of outlets - continuing operations Own stores Franchises 379 379 368 367 369 197 250 218 212 216 Stock market ratios Year end share price Shares in issue Market capitalisation Dividend yield 74p 114p 175p 131p 142p 68.3m 68.3m 68.1m 67.2m 66.6m 50.5m 77.9m 119.2m 87.8m 94.4m 8.2% 6.0% 3.9% 5.2% 4.8%