A machine acquired for 480,000 on 1 January 2006 and depreciated using the straight-line method, assuming 20

Question:

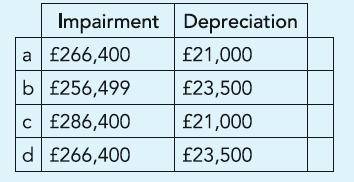

A machine acquired for £480,000 on 1 January 2006 and depreciated using the straight-line method, assuming 20 years’ life and 10% scrap value, was damaged in an accident on 1 January 2012. Though it was restored to working order at a cost of £20,000, it is expected to be operational for four years more and the present value of the income it is expected to generate is only £84,000. The machine, being of a specialised nature, cannot be sold for more than £10,000. What is the amount to be written off as impairment as at 1 January 2012 and as depreciation for the year ended 31 December 2012?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: