Alpha paid 3,600 to acquire 2,400 ordinary shares in Beta on 1 January 2010 when: (i) Betas

Question:

Alpha paid £3,600 to acquire 2,400 ordinary shares in Beta on 1 January 2010 when:

(i) Beta’s Share capital consisted of 3,000 ordinary shares of £1 each, quoted at 160p each;

(ii) Beta’s reserves stood at £840; and

(iii) the fair value of Beta’s identifiable non-monetary assets exceeded the book value by £560.

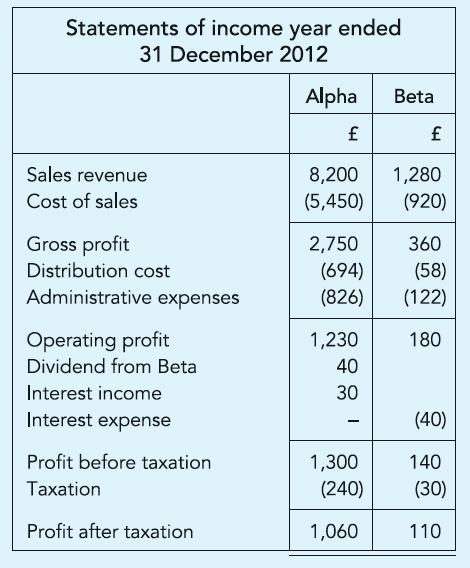

The Statements of income prepared by both companies are shown. You are informed as follows:

(a) During the year Beta sold goods to Alpha for £480, invoicing them at cost plus 20%. Goods invoiced at £96 remain with Alpha at the year-end, while those invoiced at £24 remain in transit.

(b) 75% of interest expense incurred by Beta was paid to Alpha.

(c) Depreciation, if calculated on the basis of fair values, should have been £20 more per year.

(d) As at 31 December 2012 goodwill in Beta was valued at £100.

Required: Prepare the Consolidated Statement of income for the year ended 31 December 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict