Alpha plc paid 180 to acquire the whole of the equity in Beta plc on 1 January

Question:

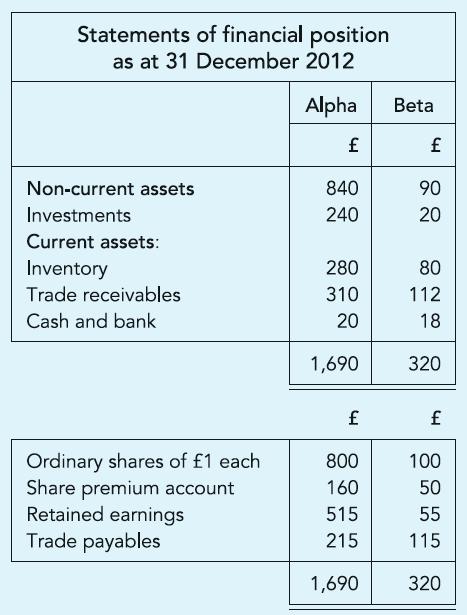

Alpha plc paid £180 to acquire the whole of the equity in Beta plc on 1 January 2012, immediately upon Beta’s incorporation. The Statements of financial position of both companies, a year after acquisition, are shown. You are informed that trade receivables reported by Alpha includes £72 due from Beta.

Required:

The Consolidated Statement of financial position of the Alpha group as at 31 December 2012.

Transcribed Image Text:

Statements of financial position as at 31 December 2012 Alpha £ Non-current assets Investments Current assets: Inventory Trade receivables Cash and bank nary shares of £1 each. Share premium account Retained earnings Trade payables 840 240 280 310 20 1,690 £ 800 160 515 215 1,690 Beta £ 90 20 80 112 18 320 4 100 50 55 115 320

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (14 reviews)

Consolidated Statement of financial position as at 31 December 2012 Noncurrent assets Goodwill In...View the full answer

Answered By

Mercy Kangai

I provide creative and detailed administrative, web search, academic writing, data entry, Personal assistant, Content writing, Translation, Academic writing, editing and proofreading services. I excel at working under tight deadlines with strict expectations. I possess the self-discipline and time management skills necessary to have served as an academic writer for the past seven years. I can bring value to your business and help solve your administrative assistant issues. I have extensive experience in marketing and small business management.

4.80+

27+ Reviews

86+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

Alpha plc paid 820,000 to acquire all of the equity shares in Beta plc on 1 January 2010 when: (i) Beta had retained earnings amounting to 80,000. (ii) Investments held by Beta had a market value of...

-

Alpha paid 405,000 to acquire 300,000 shares of 1 each in Beta plc, immediately after Betas incorporation. The Statements of financial position of both companies have been prepared as shown. You are...

-

Alpha plc paid 1,480 to acquire 2,400 shares in Beta plc. On the date of acquisition Beta plc had an accumulated loss of 180, though its property, plant and equipment had a fair value which exceeded...

-

A small, 2-ha, mostly impervious urban catchment has an average slope of 1.5% and the following average. Horton infiltration parameters: f0 = 4 mm/hr, fc = 1 mm/hr, k = 2.2 hr-1. (Infiltration occurs...

-

Raddington Industries is a diversified manufacturer with several divisions, including the Reigis Division. Raddington monitors its divisions on the basis of both unit contribution and return on...

-

In the figure below, how many pounds of sugar are sellers willing to sell at a price of $20? How much is demanded at this price? What is the buyers willingness to pay when the quantity is 20 lb? Is...

-

A birth weight of less than 3.25 pounds is classified by the NCHS as a "very low birth weight." What is the probability that a baby has a very low birth weight for each gestation period? (a) Under 28...

-

Scott Products Inc. is a merchandising company that sells binders, paper, and other school supplies. The company is planning its cash needs for the third quarter. In the past, Scott Products has had...

-

Question 2. Valuation Models The JMR Company is a family business that currently uses no debt in its capital structure. The owner-managers agreed on a plan to issue a large amount of debt to expand...

-

Alpha paid 450 to acquire 300 ordinary shares in Beta on 1 July 2010 when: (i) Betas Retained earnings were 40; (ii) Fair value of Betas property plant was 120 more than the book value; and (iii)...

-

On 1 January 2011 Alpha invested 500 to incorporate Beta. A year later each company had prepared its own Statement of financial position as shown. Required: Prepare the Consolidated Statement of...

-

Recording cost flows The R. Jones Manufacturing Company produces office furniture and uses a job order costing system to accumulate product costs. Below are a number of transac- tions that occurred...

-

SOUTHWEST AIRLINES: PROFILE OF A LEADER Airlines have faced economic difficulties with rising fuel costs and increased security standards. While many airlines have faced bankruptcy and corpo- rate...

-

a-1.If the required return is 11 percent, what is the profitability index for both projects? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project...

-

More info Mar. 1, 2024 Dec. 1, 2024 Dec. 31, 2024 Dec. 31, 2024 Jan. 1, 2025 Feb. 1, 2025 Mar. 1, 2025 Mar. 1, 2025 Borrowed $585,000 from Bartow Bank. The nine-year, 5% note requires payments due...

-

Describe the Leader(s) - Leadership Qualities/Style of Captain America in the movie The Avengers 1 (2012) Describe the actions that illustrate specific leadership characteristics and behaviors of...

-

During the current year, a company exchanged old equipment costing $ 6 4 , 0 0 0 with accumulated depreciation of $ 5 0 , 0 0 0 for a new truck. The new truck had a cash price of $ 8 0 , 0 0 0 and...

-

An electron de-excites from the fourth quantum level in the diagram of the preceding question to the third and then directly to the ground state. Two photons are emitted. How does the sum of their...

-

Information graphics, also called infographics, are wildly popular, especially in online environments. Why do you think infographics continue to receive so much attention? How could infographics be...

-

Analyze Walmart and Amazon.com using the competitive forces and value chain models.

-

Compare Walmart and Amazon's business models and business strategies.

-

What role does information technology play in each of these businesses? How is it helping them refine their business strategies?

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App