Analysis of financial statement disclosure of effects of depreciation policy. A recent annual report of Caterpillar Tractor

Question:

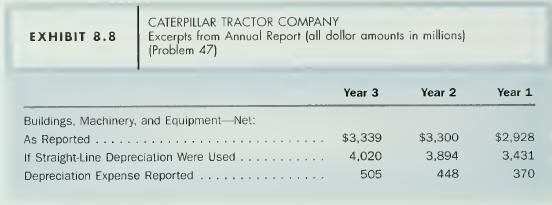

Analysis of financial statement disclosure of effects of depreciation policy. A recent annual report of Caterpillar Tractor Company contained the following statement of depreciation policy:

Depreciation is computed principally using accelerated methods for both income tax and financial reporting purposes. These methods result in a larger allocation of the cost of buildings, machinery, and equipment to operations in the early years of the lives of assets than does the straight-line method.

Then Caterpillar disclosed the amounts for "Buildings, Machinery, and Equipment

—

Net" as they would appear if the straight-line method had always been used. Exhibit 8.8 shows these amounts and other data from the financial statements for three recent years.

a. What amounts would be reported for depreciation expense for Years 2 and 3 if the straight-line method had always been used?

b. Now assume a 40 percent tax rate. Assume also that straight-line depreciation had always been used for both income tax and financial reporting purposes and that Buildings, Machinery, and Equipment—Net on the balance sheet amounted to

$4,020 at the end of Year 3. What other items on the balance sheet for the end of Year 3 would probably change and by how much?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil