Associated British Foods is a diversified international food, ingredients and retail group with sales of 12.9bn, and

Question:

Associated British Foods is a diversified international food, ingredients and retail group with sales of £12.9bn, and 118,000 employees in 47 countries across Europe, southern Africa, the Americas, Asia and Australia.

Our businesses at a glance The group operates through five strategic business segments:

Sugar, Agriculture, Retail [Primark], Grocery and Ingredients.

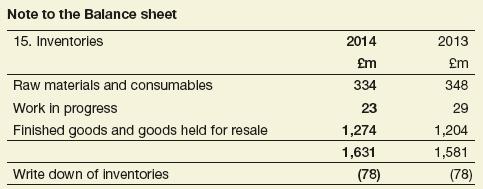

Financial review Working capital at the year end was £164m lower than last year reflecting lower food commodity prices and the benefit of management action to reduce the average level of working capital throughout the year. When expressed as a percentage of sales, this also showed further improvement. Net borrowings at the year end were £358m lower than last year at £446m as a consequence of the very strong cash flow.

Significant accounting policies: Biological assets Biological assets are measured at fair value less costs to sell. Cane roots and growing cane are stated at fair value on the following bases:

Cane roots – escalated average cost, using appropriate inflation-related indices, of each year of planting adjusted for remaining expected life, currently ten years in South Africa, nine years in Swaziland, seven years in Zambia and eight years elsewhere.

Growing cane – estimated sucrose content valued at estimated sucrose price for the following season, less estimated costs for harvesting and transport. When harvested, growing cane is transferred to inventory at fair value less costs to sell.

The fair value of cane roots and growing cane is determined using inputs that are unobservable, using the best information available in the circumstances for using the cane roots and the growing cane, and therefore fall into the level 3 fair value category.

Significant accounting policies: Inventories Inventories are stated at the lower of cost and net realisable value. Cost includes raw materials, direct labour and expenses and an appropriate proportion of production and other overheads, calculated on a first-in first-out basis. Inventories for Primark are valued at the lower of cost and net realisable value using the retail method, calculated on the basis of selling price less appropriate trading margin. All Primark inventories are finished goods.

Discussion points 1 What does the reader learn about inventory valuation from the accounting policy note?

2 How does the company value a current asset that is a growing crop?

Step by Step Answer: