Bill Hardy extracted the year-end Trial Balance at the end of his first year as shown. You

Question:

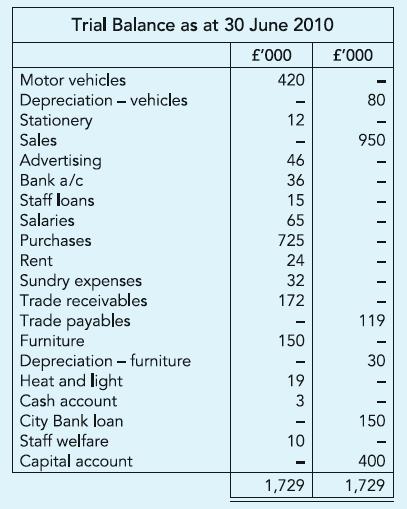

Bill Hardy extracted the year-end Trial Balance at the end of his first year as shown. You are informed:

(i) As at 30 June 2010:

Inventory costing £120,000 remains unsold

Stationery costing £3,000 remains unused

Salary £6,000 and electricity £1,000 remain unpaid.

(ii) Rent for office premises is agreed at £1,500 per month.

(iii) Interest is payable on City Bank loan at 10% per annum.

(iv) Motor vehicles and furniture are to be depreciated at 20% and 10% per annum respectively, using the reducing balance method.

(v) A trade debt of £12,000 should be written off as bad and an allowance set up for doubtful debts at 5% of debts outstanding.

(vi) Sundry expenses reported on the Trial Balance include £15,000 paid as school fee for Bill Hardy’s daughter.

Required:

Prepare the Statement of income for the first year ending 30 June 2010 and the Statement of financial position as at that date. The amounts in the Trial Balance are listed under £’000 which means that each amount has been rounded off to the nearest thousand pounds.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict