Comparing gross margins using FIFO and LIFO cost flow assumptions. Sankyo, a leading pharmaceutical company in Japan,

Question:

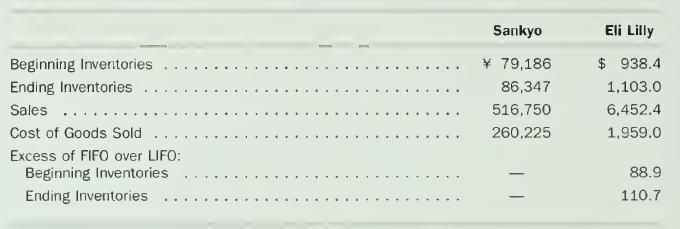

Comparing gross margins using FIFO and LIFO cost flow assumptions. Sankyo, a leading pharmaceutical company in Japan, uses a weighted-average cost flow assumption for inventories. Eli Lilly, a leading pharmaceutical company in the United States, uses a LIFO cost flow assumption. Selected data for the same year from the financial statements of the two firms appear below (in millions of yen or dollars):

a. Compute the gross margin percentage (= gross margin h- sales) for each firm based on its reported amounts.

b. Compute the gross margin percentage for Eli Lilly assuming that it had used a FIFO cost flow assumption.

c. How does the cost flow assumption affect your conclusions regarding the relative profitability of these two firms for the current year?

d. Compute the inventory turnover ratio for each firm based on its reported amounts.

e. Compute the inventory turnover ratio for Eli Lilly assuming that it had used a FIFO cost flow assumption.

f. How does the cost flow assumption affect your conclusions regarding the inventory turnovers of these two firms for the current year?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil