Comprehensive review of accounting for shareholders' equity. The shareholders' equity section of the balance sheet of Alex

Question:

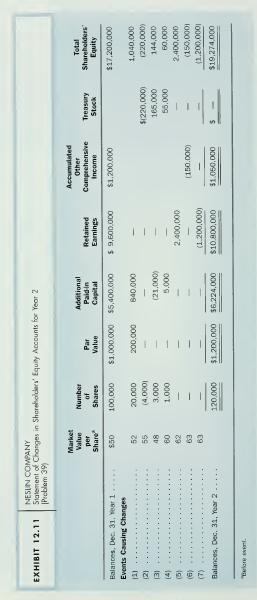

Comprehensive review of accounting for shareholders' equity. The shareholders'

equity section of the balance sheet of Alex Corporation at December 31 appears on page 719.

a. Calculate the total book value and the book value per common share as of December 31.

b. For each of the following transactions or events, give the appropriate journal entry and compute the total book value and the book value per common share of

Alex Corporation after the transaction. The transactions and events are independent of one another, except where noted.

(1) Declares a 10 percent stock dividend when the market price of Alex Corporation's common stock is $30 per share.

(2) Declares a 2-for-l stock split and reduces the par value of the cominon stock from $10 to $5 per share. The firm issues the new shares immediately.

(3) Purchases 5,000 shares of Alex Corporation's common stock on the open market for $25 per share and holds the shares as treasury stock.

(4) Purchases 5,000 shares of Alex Corporation's common stock on the open market for $ 1 5 per share and holds the shares as treasury stock.

(5) Sells, for $35 per share, the shares acquired in (3).

(6) Sells, for $20 per share, the shares acquired in (3).

(7) Sells, for $15 per share, the shares acquired in (3).

(8) Officers exercise options to acquire 5,000 shares of Alex Corporation stock for $ 1 5 per share.

(9) Same as (8), except that the exercise price is $50 per share.

(10) Holders of convertible bonds with a book value of $150,000 and a market value of $170,000 exchange them for 10,000 shares of common stock with a market value of $17 per share. The firm recognizes no gain or loss on the conversion of bonds.

(11) Same as (10), except that the firm recognizes gain or loss on the conversion of bonds into stock. Ignore income tax effects.

c. Using the results from part

b, summarize the transactions and events that result in a reduction in (I ) total book value and (2) book value per share.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil