Detailed comparison of various choices for inventory accounting. Burton Corporation commenced retailing operations on January 1 ,

Question:

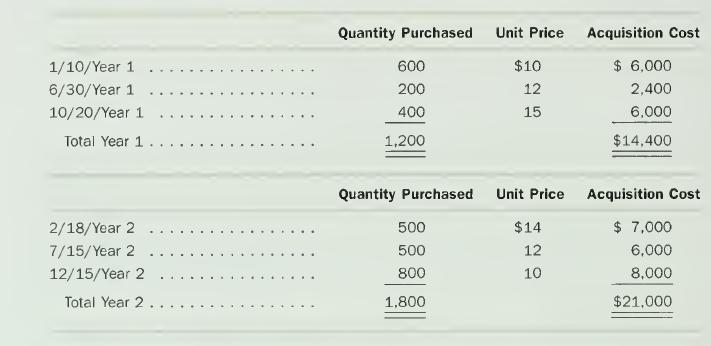

Detailed comparison of various choices for inventory accounting. Burton Corporation commenced retailing operations on January 1 , Year 1 . Purchases of merchandise inventory during Year 1 and Year 2 appear below:

Burton Corporation sold 1,000 units during Year 1 and 1,500 units during Year 2. It uses a periodic inventory system.

a. Calculate the cost of goods sold for Year 1 using a FIFO cost flow assumption.

b. Calculate the cost of goods sold for Year I using a LIFO cost flow assumption.

c. Calculate the cost of goods sold for Year 1 using a weighted-average cost flow assumption.

d. Calculate the cost of goods sold for Year 2 using a FIFO cost flow assumption.

e. Calculate the cost of goods sold for Year 2 using a LIFO cost flow assumption.

f. Calculate the cost of goods sold for Year 2 using a weighted-average cost flow assumption. g. Will FIFO or LIFO result in reporting the larger net income for Year 1? Explain. h. Will FIFO or LIFO result in reporting the larger net income for Year 2? Explain.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil