Effect of inventory valuation basis on net income. Colt Real Estate Development Corporation acquired two parcels of

Question:

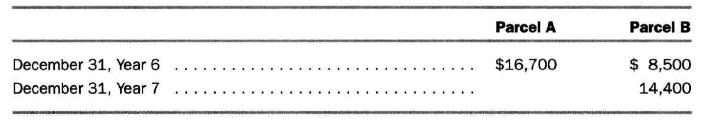

Effect of inventory valuation basis on net income. Colt Real Estate Development Corporation acquired two parcels of land, Parcel A and Parcel B, for \(\$ 9,000\) each on April 15, Year 6. The firm sold Parcel A on August 20, Year 7, for \(\$ 24,600\) and Parcel B on March 16, Year 8, for \(\$ 19,700\). The market value of the two parcels on various dates appear below:

The firm uses the calendar year as its accounting period.

a. Compute the amount of income from these two parcels of land for Year 6, Year 7, and Year 8, assuming the firm reports land inventory on its balance sheet using (1) acquisition cost, (2) market value, and (3) lower of cost or market.

b. Compare the income for Year 6, Year 7, and Year 8 and for the three years combined under the three inventory valuation bases.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil