Financial statement effects of operating and capital leases. Excerpts from the notes to the financial statements of

Question:

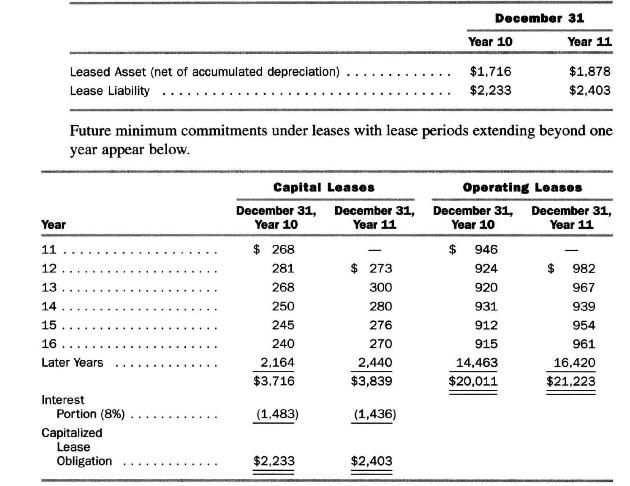

Financial statement effects of operating and capital leases. Excerpts from the notes to the financial statements of American Airlines for a recent year reveal the following (amounts in millions):

a. Assume that American Airlines makes all lease payments at the end of each year. Prepare an analysis that explains how the liability for capital leases increased from \(\$ 2,233\) million on December 31, Year 10, to \(\$ 2,403\) million on December 31, Year 11 .

b. Prepare an analysis that explains how the leasehold asset increased from \(\$ 1,716\) million on December 31, Year 10, to \(\$ 1,878\) million on December 31, Year 11.

c. Give the journal entries to account for capital leases during Year 11.

d. Give the journal entries to account for operating leases during Year 11.

e. The present value at 10 percent of American's operating lease commitments is \(\$ 7,793\) million on December 31, Year 10, and \(\$ 8,164\) million on December 31, Year 11. The leases have an average remaining useful life of 22 years on each date. Prepare the journal entries to convert these operating leases into capital leases as of December 31, Year 10, and to account for the leases as capital leases during Year 11.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil