Financial statement effects of operating and capital leases. The notes to the financial statements of American Airlines

Question:

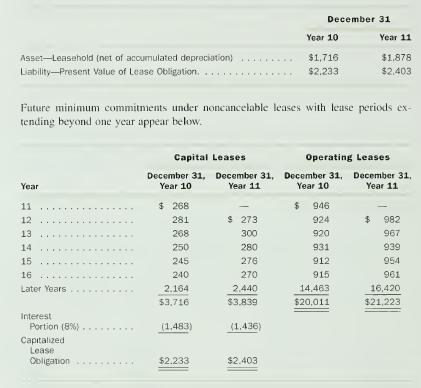

Financial statement effects of operating and capital leases. The notes to the financial statements of American Airlines for a recent year reveal the following

(amounts in millions):

a. Assume that American Airlines makes all lease payments at the end of each year. Prepare an analysis that explains how the liability for capital leases increased from $2,233 million on December 31. Year 10. to $2.403 million on December 31. Year 11.

b. Prepare an analysis that explains how the leasehold asset increased from $1.716 million on December 31. Year 10. to $1.878 million on December 31, Year 11.

c. Give the journal entries to account for capital leases during Year 11.

d. Give the journal entries to account for operating leases during Year 11.

e. The present value at 10 percent of American's operating lease commitments is $7.793 million on December 31. Year 10, and $8.164 million on December 31, Year 11. The leases have an average remaining useful life of 22 years on each date. Prepare the journal entries to convert these operating leases into capital leases as of December 31. Year 10. and to account for the leases as capital leases during Year 11. 42. Comparison of borrow/buy with operating and capital leases. Carom Sports Col- lectibles Shop plans to acquire, as of January 1. Year 1. a computerized cash register system that costs $100,000 and has a five-year life and no salvage value. The com- pany is considering two plans for acquiring the system:

(1) Outright purchase. To finance the purchase, the firm will issue $100,000 of parvalue, 10 percent semiannual coupon bonds issued January 1, Year 1, at par. The bonds mature in five years.

(2) Lease. The lease requires five annual payments on December 31, Year I, Year 2, Year 3, Year 4. and Year 5. The lease payments are such that they have a present value of $100,000 on January 1, Year 1, when discounted at 10 percent per year.

The firm will use straight-line amortization methods for all depreciation and amortization computations for assets.

a. Verify that the amount of the required lease payment is $26,380 by constructing an amortization schedule for the five payments. Note that there will be a $2 rounding error in the fifth year. Nevertheless, you may treat each payment as being $26,380 in the rest of the problem.

b. What balance sheet accounts are affected if the firm selects plan (1)? What if the firm uses plan (2), the lease is cancelable, and the firm uses the operating lease treatment? What if the firm selects plan (2), the lease is noncancelable, and it uses the capital lease treatment?

c. What is the total depreciation and interest expense for the five years under plan (1)?

d. What is the total expense for the five years under plan (2) if the firm was able to account for the lease as an operating lease? as a capital lease?

e. Why are the answers in part d the same? Why do the answers in part c differ from those in part d?

f. What is the total expense for Year 1 under plan (1)? under plan (2) accounted for as an operating lease? under plan (2) accounted for as a capital lease?

g. Repeat part f for Year 5.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil