Financial statement effects of purchase and pooling-of-interests methods. (Re- quires coverage of Appendix 11.2.) Bristol-Myers Corporation and

Question:

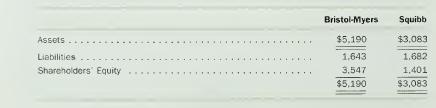

Financial statement effects of purchase and pooling-of-interests methods. (Re- quires coverage of Appendix 11.2.) Bristol-Myers Corporation and Squibb, both pharmaceutical companies, agreed to merge as of January 2. Year 10. Bristol-Myers exchanged 234 million shares of its common stock for the outstanding shares of Squibb. The shares of Bristol-Myers sold for $55 per share on the merger date, re- sulting in a transaction with a market value of $12.87 billion. Condensed balance sheet data on January 2. Year 10, appear below (amounts in millions).

a. Prepare a condensed consolidated balance sheet on the date of the merger assuming that the firms accounted for the merger using ( 1 ) the purchase method and (2) the pooling-of-interests method. Assume that any excess acquisition cost over the book value of Squibb's net assets relates to goodwill, which the firms amortize over 10 years.

b. Projected net income for Year 10 before considering the effects of the merger are $1,225 for Bristol-Myers and $523 for Squibb. Compute the amount of consolidated net income projected for Year 10 for Bristol-Myers and Squibb using ( 1 ) the purchase method and (2) the pooling-of-interests method.

c. Which method of accounting will these firms likely prefer to account for the merger? Explain.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil