In May 1976, the Skelton Company issued 100,000 shares of no-par, convertible preferred stock for ($ 50)

Question:

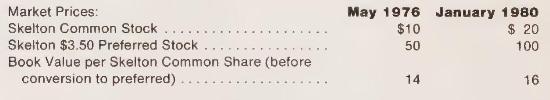

In May 1976, the Skelton Company issued 100,000 shares of no-par, convertible preferred stock for \(\$ 50\) a share. The shares promised a dividend of \(\$ 4\). All shares were issued for cash. These shares were convertible into common stock (par value, \(\$ 1\) a share) at a rate of 5 shares of common stock for each share of preferred. The preferred shares were issued when the prime interest rate was 5 percent, and they are not regarded as equivalent to common shares in the calculation of earnings per share.

The company's earnings increased sharply during the next 2 years, and during January 1980 all shares of preferred were converted into common shares. One million common shares were outstanding before conversion of the shares. If the conversion had not taken place, the net income to common for the year 1980 would have been \(\$ 2,000,000\). Other data are as follows:

a Prepare journal entries to record the issuance and conversion of the preferred stock.

b Ignore the preferred shares in computing earnings per common share before conversion of the shares. What was the effect of the conversion on book values and on earnings per common share?

c Did the conversion of the preferred shares into common stock lead to a dilution of the common shareholders' equity? Explain your reasoning.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney