In the year, total turnover of 17.7bn was down 2% (2012/13: 18.1bn). When compared to the prior

Question:

In the year, total turnover of £17.7bn was down 2% (2012/13:

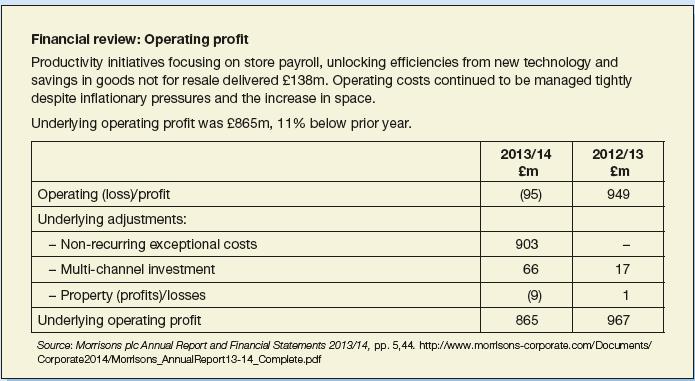

£18.1bn). When compared to the prior year the underlying operating margin of 4.9% fell by 40bps. This increased to 50bps after adjusting for the impact of a lower proportion of fuel sales in the mix this year.

Net finance costs of £82m increased by £12m over the prior period as a result of a planned increase in net debt to accommodate our peak investment of capital expenditure. Underlying profit is calculated after removing property disposals, new business development costs, non-recurring exceptional costs and IAS19 pension interest.

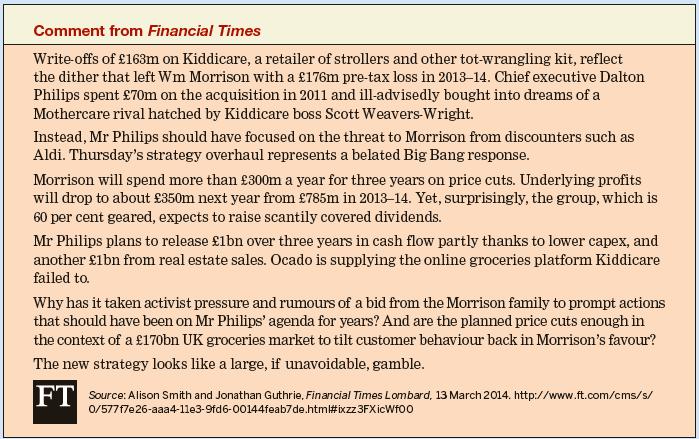

Underlying operating profit of £865m fell by 11% when compared to the prior year, with underlying profit before tax of £785m, down by 13%.

Exceptional non-recurring costs of £903m were charged in the year including £163m in relation to Kiddicare, a business which is no longer strategic. We will look to sell this business in 2014. £319m relates to elements of our store pipeline. Following a reassessment of their potential to meet our required investment criteria we have impaired £90m of costs to date and provided for £229m of further costs. A charge of £379m has been incurred in relation to trading stores, comprising of £330m of impairment and £49m of onerous lease provisions.

A further cut in the rate of corporation tax and the positive impact of the Group’s equity retirement programme partly helped to offset the impact of the reduction in underlying earnings on earnings per share (EPS). Underlying basic EPS decreased by 8% to 25.2p (2012/13: 27.3p) with statutory basic earnings per share of (10.2)p (2012/13: 26.7p).

Step by Step Answer: