Interpreting disclosures regarding property, plant, and equipment. PepsiCo reports the following information in its financial statements and

Question:

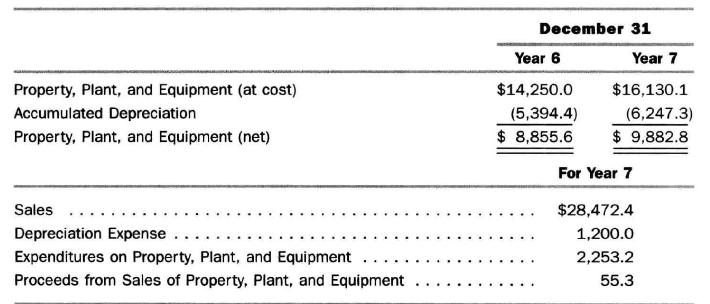

Interpreting disclosures regarding property, plant, and equipment. PepsiCo reports the following information in its financial statements and notes in a recent year (amounts in millions):

a. Give the journal entries for the transactions and events that account for the changes in the Property, Plant, and Equipment account and the Accumulated Depreciation account during Year 7.

b. PepsiCo uses the straight-line depreciation method for financial reporting. Estimate the average total life of property, plant, and equipment in use during Year 7.

c. Refer to part

b. Estimate the average age to date of property, plant, and equipment in use during Year 7.

d. Compute the fixed asset turnover for Year 7.

e. PepsiCo uses accelerated depreciation for income tax purposes. From information in the financial statement note on income taxes (discussed in Chapter 10), the balance in the accumulated depreciation account using accelerated depreciation would have been $\$ 7,018.8$ on December 31, Year 6, and $\$ 7,736.7$ on December 31, Year 7. Compute the plant asset turnover ratio using accelerated depreciation.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil