Journal entries and consolidation work-sheet entries for various methods of accounting for intercorporate investments. Rockwell Corporation acquired,

Question:

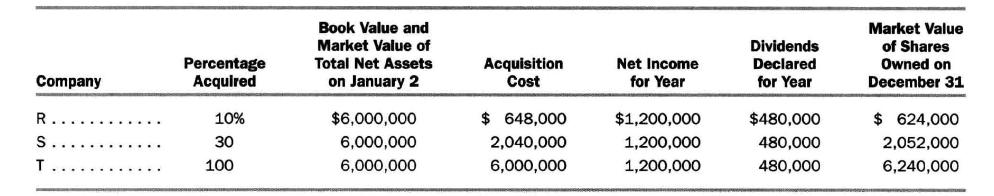

Journal entries and consolidation work-sheet entries for various methods of accounting for intercorporate investments. Rockwell Corporation acquired, as long-term investments, shares of common stock of Company R, Company S, and Company T on January 2. These are the only long-term investments in securities that Rockwell Corporation holds. Data relating to the acquisitions follow.

a. Give the journal entries made to acquire the shares of Company \(\mathrm{R}\) and to account for the investment during the year, using the market value method.

b. Give the journal entries made to acquire the shares of Company \(\mathrm{S}\) and to account for the investment during the year, using the equity method. Any excess cost relates to goodwill. The firm neither amortizes any goodwill nor finds it impaired.

c. Give the journal entries made to acquire the shares of Company T and to account for the investment during the year, using the equity method.

(Parts d through \(\mathbf{g}\) require coverage of Appendix 11.1.)

d. Give the consolidation work sheet entry to eliminate the Investment in Stock of Company \(\mathrm{T}\) account at the end of the year, assuming that Rockwell uses the equity method and that the work sheet starts with preclosing trial balance amounts. Company T had \(\$ 2,400,000\) in its Common Stock account throughout the year and a zero balance in Additional Paid-in Capital.

e. Repeat part

d, but assume that the work sheet starts with postclosing trial balance amounts.

f. Assume that Rockwell Corporation had acquired the shares of Company T for \(\$ 6,600,000\) instead of \(\$ 6,000,000\). Give the journal entries made during the year to acquire the shares of Company \(\mathrm{T}\) and to account for the investment using the equity method. Rockwell Corporation treats \(\$ 300,000\) of any excess of acquisition cost over book value as an unrecorded patent that has a 5 -year remaining life on the date of acquisition and any remaining excess as goodwill.

g. Refer to part

f. Give the consolidation work sheet entry to eliminate the Investment in Stock of Company \(\mathrm{T}\) account, assuming the work sheet uses preclosing trial balance data.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil