Miller Company and Gordon Company merge in a pooling of interests. Miller Company issues 12,500 shares with

Question:

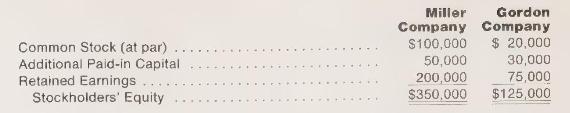

Miller Company and Gordon Company merge in a pooling of interests. Miller Company issues 12,500 shares with market value of \(\$ 150,000\) for 100 percent of Gordon's shares, which have a book value of \(\$ 125,000\). Data for the two companies before the merger are shown below.

Construct the pooled stockholders' equity accounts. Assume that Miller Company's stock has a par value per share of a \(\$ 4\).

b \(\$ 6\).

c \(\$ 10\)

d \(\$ 12\).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney

Question Posted: