On 1 January 2012 Falkirk plc moved into its new premises acquired at a cost of 500,000

Question:

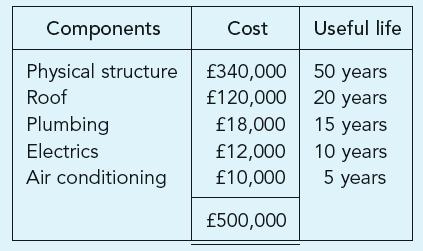

On 1 January 2012 Falkirk plc moved into its new premises acquired at a cost of £500,000 and wishes to depreciate it using the straight-line method. Its structural engineer reports as stated.

Required:

Calculate the depreciation to be written off in the year ending 31.12.2012.

Transcribed Image Text:

Components Physical structure Roof Plumbing Electrics Air conditioning Cost £340,000 £120,000 £18,000 £12,000 £10,000 £500,000 Useful life 50 years 20 years 15 years 10 years 5 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

On the component approach the depreciation for the year w...View the full answer

Answered By

Irfan Ali

I have a first class Accounting and Finance degree from a top university in the World. With 5+ years experience which spans mainly from the not for profit sector, I also have vast experience in preparing a full set of accounts for start-ups and small and medium-sized businesses. My name is Irfan Ali and I am seeking a wide range of opportunities ranging from bookkeeping, tax planning, business analysis, Content Writing, Statistic, Research Writing, financial accounting, and reporting.

4.70+

249+ Reviews

530+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

The trial balance for LPO at 31 December 2013 was as follows: Notes: (i) Closing inventory at 31 December 2013 was $562,000. (ii) On 31 December 2013, LPO disposed of some obsolete plant and...

-

The general manager of the nationalized postal service of a small country, Zedland, wishes to introduce a new service. This service would offer same-day delivery of letters and parcels posted before...

-

Salim purchased machinery for $15,000 on 1 January 201. He decided to depreciate it using the straight line method at 10% per annum. On 31 December 202 he incorrectly charged depreciation using the...

-

What has motivated you most since accepting your Omega Nu Lambda nomination to grow in your career development? Give an example

-

What is the purpose of the alternative minimum tax?

-

Does Clark have any sources of power and any contingencies of power? If so, list and discuss them.

-

14. Using the zero-coupon bond yields in Table 9, what is the fixed rate in a 4-quarter interest rate swap? What is the fixed rate in an 8-quarter interest rate swap?

-

SummerFun, Inc., produces a variety of recreation and leisure products. The production manager has developed an aggregate forecast: Develop an aggregate plan using each of the following guidelines...

-

Cycle Time and Velocity In the first quarter of operations, a manufacturing cell produced 145,000 stereo speakers, using 16,000 production hours. In the second quarter, the cycle time was 10 minutes...

-

Sawa plc commenced construction of its head offices on 1 March 2012. Construction was completed by 1 December at a cost of 324,000. Because of local flooding, construction work was suspended for a...

-

In addition to 98,400 already paid in 2012, the advertising agent has sent an invoice for a further amount of 61,800. 45,000 of the invoice is for a television campaign commencing January 2013. Which...

-

One cubic meter of an ideal gas at 600 K and 1,000 kPa expands to five times its initial volume as follows; (a) By a mechanically reversible, isothermal process. (b) By a mechanically reversible,...

-

Q Proprietorinc (the lessee) enters into a 10 year lease of a property with an option to extend the contract for 5 years. Lease payments are $50,000 per year, payable at the beginning of each year....

-

1.Think about your investment Possibility for 3 years holding period in real investment environment? A.What could be your investment objectives? B. What amount of fund you could invest for three...

-

3- The student council normally sells 1500 school T-shirts for $12 each. This year they plan to decrease the price of the T-shirts. Based on student feedback, they know that for every $0.50 decrease...

-

2. The notation {f(x): x S} means "the set of all values that can be produced by substituting an element x of set S into f(x)." For example, the set of all odd integers can be expressed as {2k+1kZ}....

-

Implementation guidance for IFRS 2 indicates that it "accompanies, but is not part of, IFRS 2." In other words, this implementation guidance is considered mandatory. integral to the standard. not...

-

Freitas, El-Hani, and da Rocha (2008) tested the hypothesis that rodent species (four different species) and sex (male, female) influence the level of affiliation acquired through social behavior....

-

Design and describe an application-level protocol to be used between an automatic teller machine and a bank's centralized computer. Your protocol should allow a user 's card and password to be...

-

Doug receives a duplex as a gift from his uncle. The uncles basis for the duplex and land is $90,000. At the time of the gift, the land and building have FMVs of $40,000 and $80,000, respectively. No...

-

During the current year, Stan sells a tract of land for $800,000. The property was received as a gift from Maxine on March 10, 1995, when the property had a $310,000 FMV. The taxable gift was...

-

Bud received 200 shares of Georgia Corporation stock from his uncle as a gift on July 20, 2016, when the stock had a $45,000 FMV. His uncle paid $30,000 for the stock on April 12, 2001. The taxable...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

Study smarter with the SolutionInn App