On July 1, 1978, the accounts of the Tampa Manufacturing Company contained the following balances: Transactions for

Question:

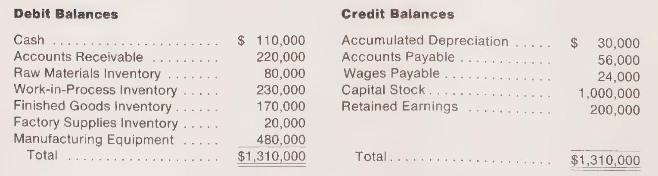

On July 1, 1978, the accounts of the Tampa Manufacturing Company contained the following balances:

Transactions for the month of July are listed below in summary form:

(1) Sales, all on account, were \(\$ 310,000\).

(2) Labor services furnished by employees during the period (but as yet unpaid) amounted to \(\$ 80,000\). All labor is employed in the factory.

(3) Factory supplies were purchased for \(\$ 8,500\); payment was made by check.

(4) Raw materials purchased on account, \(\$ 100,000\).

(5) Collections from customers, \(\$ 335,000\).

(6) Payment of \(\$ 108,000\) was made to raw materials suppliers.

(7) Payments to employees total \(\$ 78,500\).

(8) Rent of the factory building for the month, \(\$ 8,000\), was paid.

(9) Depreciation of manufacturing equipment for the month, \(\$ 12,000\).

(10) Other manufacturing costs incurred and paid, \(\$ 40,000\).

(11) All selling and administrative services are furnished by Clark and Company for \(\$ 10,000\) per month. Their bill was paid by check.

(12) Raw materials used during month, \(\$ 115,000\).

(13) Factory supplies used during month, \(\$ 8,000\).

(14) Cost of goods completed during month, \(\$ 258,000\).

(15) Goods costing \(\$ 261,500\) were shipped to customers during the month.

a Open T-accounts and record the July 1, 1979, amounts. Record transactions (1) through (15) in the T-accounts, opening additional accounts as needed.

b Prepare an adjusted, preclosing trial balance as of July 31, 1979.

c Prepare a combined statement of income and retained earnings for July 1979.

d Enter closing entries in the T-accounts using an Income Summary account.

e Prepare a balance sheet as of July 31, 1979.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney