Preparing a consolidation work sheet. (Requires coverage of Appendix 11.1.) The trial balances of Peak Company and

Question:

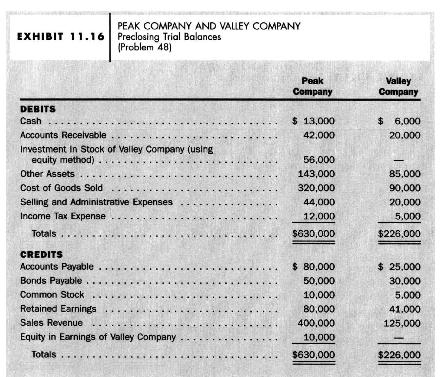

Preparing a consolidation work sheet. (Requires coverage of Appendix 11.1.) The trial balances of Peak Company and Valley Company on December 31 of the current year appear in Exhibit 11.16.

Peak Company acquired all of the common stock of Valley Company on January 1 of this year for \(\$ 50,000\). The shareholders' equity of Valley Company on January 1 comprised \(\$ 5,000\) of common stock and \(\$ 45,000\) of retained earnings. Valley Company earned \(\$ 10,000\), and declared and paid dividends of \(\$ 4,000\) during the current year. The preclosing trial balances on December 31 contain advances from Peak Company to Valley Company totaling \(\$ 8,000\); Peak includes the advances in its Accounts Receivable; Valley shows the advances in its Accounts Payable.

a. Prepare a consolidation work sheet for Peak Company and Valley Company for the current year. The adjustments and elimination columns should contain entries

to (1) eliminate the investment account and (2) eliminate intercompany receivables and payables.

b. Assume for parts b and c that Peak Company paid \(\$ 70,000\), instead of \(\$ 50,000\), for all of the common stock of Valley Company. The market values of Valley Company's recorded assets and liabilities equaled their book values. Valley Company holds a patent that resulted from the firm's internal research and development efforts. The patent has a zero book value, a \(\$ 20,000\) market value, and a 10 year remaining life on the date of the acquisition. Compute the balance in the Investment in Stock of Valley Company on Peak Company's books at the end of the current year.

c. Give the consolidation work-sheet entry to eliminate the investment account at the end of the current year.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil