Preparing a statement of cash flows. (Adapted from a problem prepared by Stephen A. Zeff.) Selected information

Question:

Preparing a statement of cash flows. (Adapted from a problem prepared by Stephen A. Zeff.) Selected information from the accounting records of Breda Enter- prises Inc. appears below. The firm uses a calendar year as its reporting period. You are asked to prepare a statement of cash flows for Breda Enterprises Inc. for Year 6. Key all figures in the statement of cash flows to the numbered items below, (1) Net income for Year 6 is $90,000.

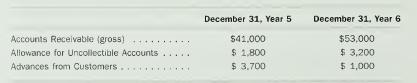

(2) Beginning and ending balances in three accounts relating to the firm's customers were as follows:

On November 1. Year 6, a customer gave the firm a six-month, 8 percent. $15.000 note in satisfaction of an account receivable of $15.000. Interest is payable at ma- turity. This was the only note receivable held by the company during Year 6.

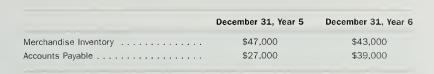

(3) The balances in Merchandise Inventory and Accounts Payable were as follows:

(4) During Year 6 the firm sold, for $25,000 cash, equipment with a book value of $38,000. The firm also purchased equipment for cash. Depreciation expense for Year 6 was $42,000. The balance in the Equipment account at acquisition cost decreased $26,000 between the beginning and end of Year 6. The balance in the Accumulated Depreciation account increased $11,000 between the beginning and end of Year 6.

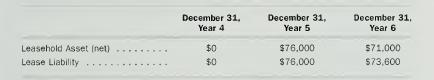

(5) The balances in the Leasehold Asset and Lease Liability accounts were as follows on various dates:

On December 31. Year 3. the tirm signed a long-term lease which, by its terms, qualified as a capital lease. The firm made a payment under the lease of $10,000 on December 31, Year 6.

(6) The firm declared cash dividends during Year 6 of $26,000. of which $10,000 remains unpaid on December 31. Year 6. During Year 6, the firm paid $8,000 cash for dividends declared during Year 5.

(7) The firm classifies all marketable securities as available for sale. It purchased no marketable securities during Year 6 but sold marketable equity securities that had originally cost $4,500 for $9,100 cash in November, Year 6. The market and book values of marketable equity securities were $4,000 on December 3 1 , Year 5. and $10,500 on December 31. Year 6.

(8) Investors in $100,000 face value of convertible bonds of Breda Enteiprises Inc.

converted them into 8,000 shares of the firm's $12-par value common stock during Year 6. The common stock had a market value of $15 per share on the conversion date. Breda Enteiprises Inc. had originally issued the bonds at a premium.

Their book value on the date of the conversion was $105,000. The firm chose the generally accepted (alternative) accounting principle of recording the issuance of the common stock at market value and recognizing a loss of $15,000.

The loss is not classified as an extraordinary item. The firm amortized $1,500 of the bond premium between January 1. Year 6. and the date of the conversion.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259623

9th Edition

Authors: Clyde P. Stickney, Roman L. Weil