Preparing a statement of cash flows. (Adapted from CPA examination.) Exhibit 13.10 presents a comparative statement of

Question:

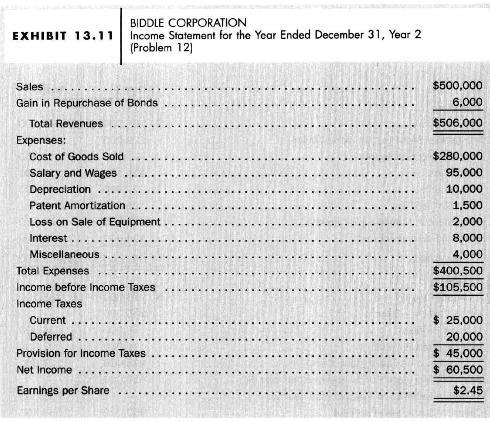

Preparing a statement of cash flows. (Adapted from CPA examination.) Exhibit 13.10 presents a comparative statement of financial position for Biddle Corporation as of December 31, Year 1 and Year 2. Exhibit 13.11 presents an income statement for Year 2. Additional information follows:

(1) On February 2, Year 2, Biddle issued a 10-percent stock dividend to shareholders of record on January 15, Year 2. The market price per share of the common stock on February 2, Year 2, was \(\$ 15\).

(2) On March 1, Year 2, Biddle issued 1,900 shares of common stock for land. The common stock and land had current market values of approximately \(\$ 20,000\) on March 1, Year 2.

(3) On April 15, Year 2, Biddle repurchased long-term bonds with a face and book value of \(\$ 25,000\). It reported a gain of \(\$ 6,000\) on the income statement.

(4) On June 30, Year 2, Biddle sold equipment costing \(\$ 26,500\), with a book value of \(\$ 11,500\), for \(\$ 9,500\) cash.

(5) On September 30, Year 2, Biddle declared and paid a \(\$ 0.04\) per share cash dividend to shareholders of record on August 1, Year 2.

(6) On October 10, Year 2, Biddle purchased land for \(\$ 42,500\) cash.

(7) Deferred income taxes represent timing differences relating to the use of different depreciation methods for income tax and financial statement reporting.

a. Prepare a T-account work sheet for the preparation of a statement of cash flows.

b. Prepare a formal statement of cash flows for Biddle Corporation for the year ended December 31, Year 2.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil