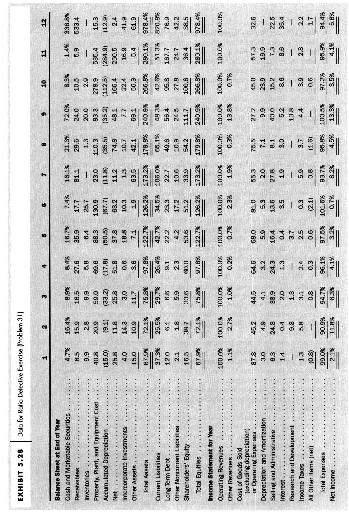

Preparing pro forma financial statements (requires Appendix 5.1). Problem 27 presents financial statements for Wal-Mart Stores, Inc.

Question:

Preparing pro forma financial statements (requires Appendix 5.1). Problem 27 presents financial statements for Wal-Mart Stores, Inc. for Year 8, Year 9, and Year 10 , as well as financial statement ratios.

a. Prepare a set of pro forma financial statements for Wal-Mart Stores, Inc. for Year 11 through Year 14 using the following assumptions:

\section*{Income Statement}

1. Sales grew 15.0 percent in Year 8, 20.3 percent in Year 9, and 15.9 percent in Year 10, primarily as a result of significant increases in same store sales and corporate acquisitions in Year 8 and Year 9. The compound annual growth rate during the last five years was 15.9 percent. Although Wal-Mart will continue to grow internationally by acquiring other firms and domestically by converting discount stores to supercenters, competition will likely constrain increases in same store sales. Thus, assume that sales will grow 15.9 percent each year between Year 11 and 14.

2. Other revenues have been approximately one percent of sales during the last three years. Assume that other revenues will continue at this historical pattern.

3. The cost of goods sold to sales percentage steadily declined between Year 8 and Year 10. Wal-Mart's everyday-low-price strategy, its movement into grocery products, and competition will likely inhibit additional significant reductions in this expense percentage. Assume that the cost of goods sold to sales percentage will be 78.4 percent for Year 11 to Year 14.

4. The selling and administrative expense percentage has steadily increased from 16.4 percent of sales in Year 8 to \(16.6 \%\) of sales in Year 10. Identifying and transacting international corporate acquisitions and opening additional supercenters will put upward pressure on this expense percentage. Spreading fixed selling and administrative costs over a larger sales base, however, will provide some benefits of economies of scale. Assume that the selling and administrative expense to sales percentage will be 16.8 percent for Year 11 to Year 14.

5. Wal-Mart has engaged in long-term borrowing to construct new stores domestically and in both short- and long-term borrowing to finance corporate acquisitions. The average interest rate on all interest-bearing debt was approximately 5 percent during Year 10. Assume this interest rate for all borrowing outstanding (notes payable, long-term debt, and current portion of long-term debt) for Wal-Mart for Year 11 and Year 14. Compute interest expense on the average amount of interest-bearing debt outstanding each year.

6. Wal-Mart's average income tax rate as a percentage of income before income taxes has varied between 37 percent and 38.2 percent during the last three years. Assume an income tax rate of 37. 4 percent of income before income taxes for Year 11 to Year 14.

7. Wal-Mart's dividends increased at an average annual rate of 24 percent between Year 8 and Year 10. Assume that dividends will grow 24 percent each year between Year 11 and Year 14.

\section*{Balance Sheet}

8. Cash will be the amount necessary to equate total assets with total liabilities plus shareholders' equity.

9. Accounts receivable will increase at the growth rate in sales.

10. Wal-Mart increased its inventory turnover ratio during the last three years. The increasing role of grocery products should result in even faster inventory turnover in the future. However, the stocking of new stores and the distribution of merchandise to stores worldwide should slow the inventory turnover. Assume that inventory will grow at the growth rate in sales.

11. Prepayments relate to ongoing operating costs, such as rent and insurance. Assume that prepayments will grow at the growth rate in sales.

12. Property, plant, and equipment grew 16.1 percent annually during the most recent five years. The construction of new supercenters and the acquisition of established retail chains abroad will require substantial investments in property, plant, and equipment. Assume that property, plant, and equipment will grow 16.1 percent each year between Year 11 and Year 14.

13. Other assets primarily include intangibles arising from corporate acquisitions abroad. Assume that other assets will grow at the growth rate in property, plant, and equipment.

14. Accounts payable turned over approximately 10.8 times per year during Year 10. Assume that accounts payable will continue to turn over 10.8 times per year.

15. Wal-Mart used short-term borrowing (Notes Payable) to help finance corporate acquisitions in recent years. These funds were used to finance the inven-

tories of the acquired companies. Assume that notes payable will grow at the growth rate in property, plant, and equipment.

16. The notes to Wal-Mart's financial statements indicate that current maturities of long-term debt on January 31 of each year are as follows: Year 10, \(\$ 4,375\) (amount already appears on the January 31, Year 10, balance sheet); Year 1, \(\$ 1,362\); Year 12, \$809; Year 13, \$1,926; Year 14, \$750.

17. Other current liabilities relate to ongoing operating activities and are expected to grow at the growth rate in sales.

18. Wal-Mart uses long-term debt to finance acquisitions of property, plant, and equipment and acquisition of existing retail chains abroad. Assume that longterm debt will decrease by the amount of long-term debt reclassified as a current liability each year and then the remaining amount will increase at the growth rate in property, plant, and equipment and other assets. For example, the January 31, Year 10, balance sheet of Wal-Mart shows the current portion of long-term debt to be \(\$ 4,375\). Wal-Mart will repay this amount during the fiscal Year 11. During fiscal Year 11, Wal-Mart will reclassify \(\$ 1,362\) from long-term debt to current portion of long-term debt. This will leave a preliminary balance in long-term debt of \(\$ 18,776\) ( \(=\$ 20,138\) - \$1,362). Wal-Mart will increase this amount of long-term debt by the 16.1 percent growth rate in property, plant, and equipment and other assets. The projected amount for long-term debt on the January 31, Year 1, balance sheet is \(\$ 21,799\) \((=\$ 18,776 \times 1.16)\).

19. Other noncurrent liabilities include an amount related to healthcare benefits and deferred taxes. Assume that other noncurrent liabilities will increase at the growth rate in sales.

20. Assume that common stock and additional paid in capital will not change.

Statement of Cash Flows 21. Assume that depreciation and amortization expense will increase at the growth rate in property, plant, and equipment and other noncurrent assets. You can include depreciation and amortization on a single line in the operating section of the statement of cash flows. To compute cash flows from investing activities, assume that 95 percent of depreciation and amortization expense is depreciation of property, plant, and equipment and that 5 percent is amortization of intangibles included in other noncurrent assets.

22. Assume that changes in other noncurrent assets on the balance sheet are an investing activity.

23. Assume that changes in other noncurrent liabilities on the balance sheet are an operating activity.

b. Describe actions that Wal-Mart Stores might take to deal with the shortage of cash projected in part a.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil