Preparing T-account entries, income statement, and balance sheet for a manufacturing firm. Wilmington Chemical Company commenced operations

Question:

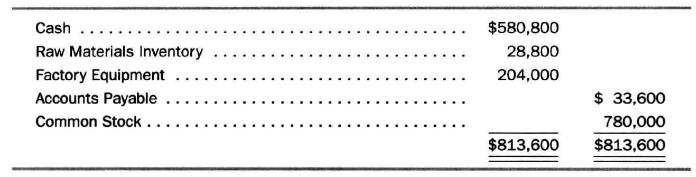

Preparing T-account entries, income statement, and balance sheet for a manufacturing firm. Wilmington Chemical Company commenced operations on October 1. The trial balance at that date was as follows:

The following data relate only to the manufacturing operations of the firm during October:

(1) Purchased materials on account for \(\$ 242,400\).

(2) Received labor services from factory employees totaling \(\$ 222,000\) and paid \(\$ 168,630\) of this amount; see (5) below.

(3) Requisitioned and put into process during the month raw materials costing \(\$ 253,200\).

(4) Acquired equipment during the month at a cost of \(\$ 168,000\). The firm made a down payment of \(\$ 60,000\) and signed an equipment contract payable in eight equal monthly installments for the remainder.

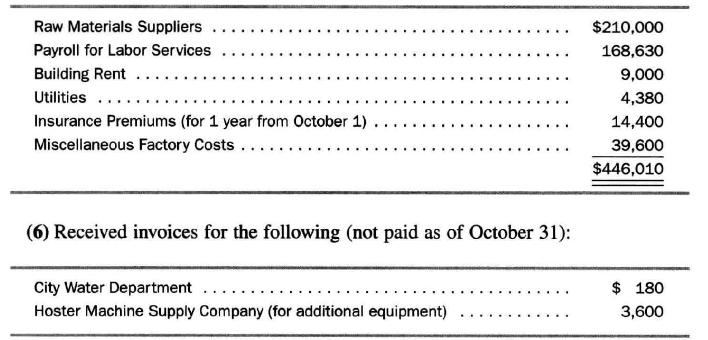

(5) Paid the following in cash:

(7) Computed depreciation on equipment for the month of \(\$ 1,800\).

(8) Recorded one month's insurance expiration.

(9) The cost of parts finished during October was \(\$ 422,625\).

In addition to these manufacturing activities, the following transactions relating to selling and administrative activities occurred during October:

(10) Made sales, on account, totaling \(\$ 510,900\).

(11) Collected cash from customers from sales on account, \(\$ 495,000\).

(12) Selling and office employees earned salaries during the month as follows: sales, \(\$ 46,200\); office \(\$ 46,800\).

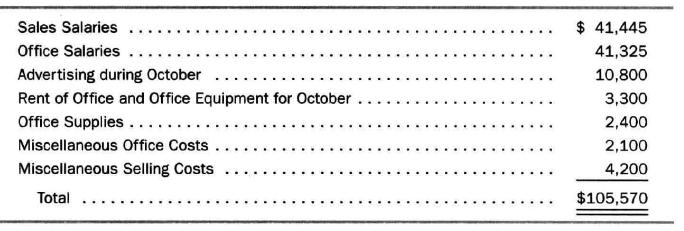

(13) Paid the following in cash:

(14) The inventory of office supplies on October 31 was \(\$ 1,200\).

(15) The inventory of finished goods on October 31 was \(\$ 88,500\).

a. Open T-accounts and enter the amounts from the opening trial balance.

b. Record the transactions during the month in the T-accounts, opening additional accounts as needed.

c. Enter closing entries in the T-accounts, using an Income Summary account.

d. Prepare a combined statement of income and retained earnings for the month.

e. Prepare a balance sheet as of October 31.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780324183511

10th Edition

Authors: Clyde P. Stickney, Roman L. Weil