The adjusting entries for the following adjustments were omitted at year-end: a. Prepaid rent expired, $2,500. b.

Question:

The adjusting entries for the following adjustments were omitted at year-end:

a. Prepaid rent expired, $2,500.

b. Depreciation, $1,000.

c. Employee salaries owed for Monday through Wednesday of a five-day work¬ week, $3,100.

d. Supplies used during the year, $800.

e. Unearned service revenue now earned, $4,500.

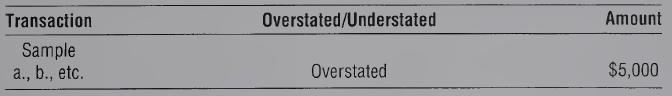

Requirement 1. Compute the amount that net income for the year is overstated or understated by for each omitted entry. Use the following format to help analyze the transactions.

Requirements 1. Calculate balances in the accounts and use the appropriate accounts to pre¬ pare the income statement of Metal Main, Inc., for the year-ended August 31, 2010. List expenses in order from largest to smallest.

2. Were the 2010 operations successful? Give the reason for your answer.

Step by Step Answer: