The CAR Corporation manufactures computers in the United States. It owns 75 percent of the voting stock

Question:

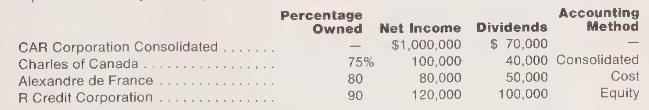

The CAR Corporation manufactures computers in the United States. It owns 75 percent of the voting stock of Charles of Canada, 80 percent of the voting stock of Alexandre de France (in France), and 90 percent of the voting stock of \(\mathrm{R}\) Credit Corporation (a finance company). The CAR Corporation prepares consolidated financial statements consolidating Charles of Canada, using the equity method for \(\mathrm{R}\) Credit Corporation. and using the lowerof-cost-or-market method for its investment in Alexandre de France. Data from the annual reports of these companies are given below.

a Which, if any, of the companies is incorrectly accounted for by CAR according to generally accepted accounting principles?

Assuming the accounting for the three subsidiaries shown above to be correct, answer the following questions.

b How much of the net income reported by CAR Corporation Consolidated is attributable to the operations of the three subsidiaries?

c What is the amount of the minority interest shown on the income statement and how does it affect net income of CAR Corporation Consolidated?

d If all three subsidiaries had been consolidated, what would have been the net income of CAR Corporation Consolidated?

e If all three subsidiaries had been consolidated, what would be the minority interest shown on the income statement?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney