The discussion in the appendix to this chapter points out that suppliers and employees who do not

Question:

The discussion in the appendix to this chapter points out that suppliers and employees who do not demand immediate cash payments for their goods and services are effectively supplying a firm with cash, at least temporarily. In parallel, when a firm does not demand immediate payment for sales, but instead accepts an increased amount of accounts receivable, it is in effect using its own liquidity to supply cash to customers. Other things being equal, a firm would like to restrict severely the amount of cash loaned interest free to customers (through accounts receivable) and increase without limit the amount of cash borrowed interest free from suppliers and employees (through accounts and wages payable).

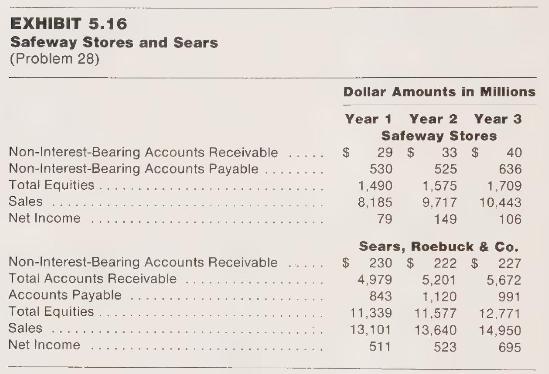

Shown here are excerpts from the financial statements of Safeway Stores and of Sears, Roebuck \& Co. for three recent years. Both of these companies are retailers-Safeway carries out most of its operations in grocery stores where most sales are for cash, whereas Sears' makes many credit sales in its department stores. Some of Sears' credit sales, those for which payment is to be made more than 1 month or so after the sale, carry explicit interest charges to the customer. There are no interest charges on the remainder of Sears' credit sales.

Analyze the data given in Exhibit 5.16. Determine which company seems to be more successful in financing its operations with interest-free capital. Which company seems to be doing better over the three years reported on here? On what analysis do you base your answer?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney