The Harrison Corporation was organized and began retailing operations on January 1, 1979. Purchases of merchandise inventory

Question:

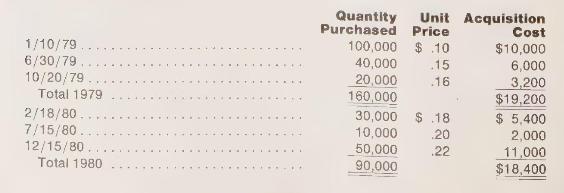

The Harrison Corporation was organized and began retailing operations on January 1, 1979. Purchases of merchandise inventory during 1979 and 1980 were as follows:

The number of units sold during 1979 and 1980 was 90,000 units and 110,000 units, respectively. Harrison Corporation uses a periodic inventory method.

a Determine the cost of goods sold during 1979 under the FIFO cost-flow assumption.

b Determine the cost of goods sold during 1979 under the LIFO cost-flow assumption.

c Determine the cost of goods sold during 1979 under the weighted-average cost-flow assumption.

d Determine the cost of goods sold during 1980 under the FIFO cost-flow assumption.

e Determine the cost of goods sold during 1980 under the LIFO cost-flow assumption.

f Determine the cost of goods sold during 1980 under the weighted-average cost-flow assumption.

g For the 2 years, 1979 and 1980, taken as a whole, will FIFO or LIFO result in reporting the larger net income? What is the difference in net income for the 2 -year period under FIFO as compared to LIFO? Assume an income tax rate of 40 percent for both years.

h Which method, LIFO or FIFO, should Harrison Corporation probably prefer and why?

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney