The numbers in this problem are hypothetical. but the size relation between them is adapted from recent

Question:

The numbers in this problem are hypothetical. but the size relation between them is adapted from recent financial statements of Sears, Roebuck \& Co. The purpose of this problem is to demonstrate the effects of deferred income tax accounting in a retailing operation.

Sears reports income on a charge account sale in the tax year when the sale is made, but reports the income on the tax return in the year when the cash is collected from the customer. Every Christmas season, Sears makes hundreds of millions of dollars of sales that are not collected until the next tax year. Each year, the Christmas sales exceed the previous year's Christmas sales. The tax on these sales is not paid until the next year, but Sears must report the tax on the current year's income statement. In recent years, the amount of the deferred tax expense for these charge sales alone has been larger than 10 percent of Sears' entire aftertax net income. The balance sheet amount of Sears' deferred tax liability for charge sales alone is of the order of \(\$ 1\) billion and has never declined. That \(\$ 1\) billion would be part of its Retained Earnings account if Sears were not required to report deferred income taxes on those charge sales. Retained Earnings would be about 20 percent larger.

Sears will have to pay its deferred taxes for charge sales only when its dollar sales shrink in amount while it remains profitable. This is unlikely ever to happen. When W. T. Grant, another large retailer, went bankrupt in the mid-1970s, it had a large credit balance in its deferred tax account that disappeared in one year. But not a single penny was paid to the government for deferred taxes.

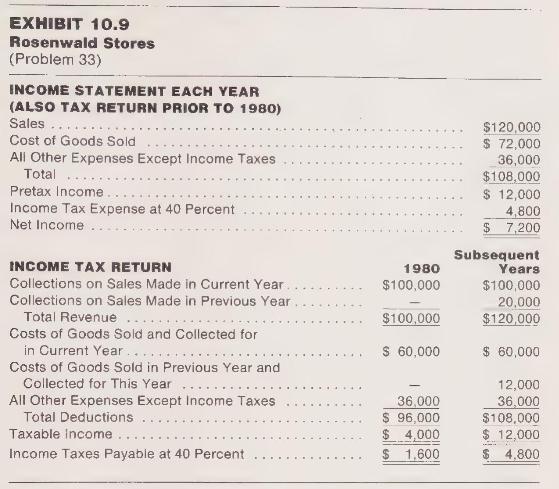

Assume (for parts a-d) that Rosenwald Stores makes all of its sales on account, that the physical amount sold remains constant each year, and that prices are stable from year to year. Of those sales, five-sixths are collected in the year of sale and one-sixth is collected in the next year. The financial statements of Rosenwald Stores in each year are shown in Exhibit 10.9. Rosenwald Stores has been using the sales basis of revenue recognition on its tax returns, so that there have been no timing differences. In 1980, Rosenwald Stores, following the rule of least and latest, switches to the installment method of revenue recognition on its income tax returns. Its tax returns for 1980 differ from tax returns for all subsequent years. These tax returns are also shown in Exhibit 10.9. The income tax rate is 40 percent.

a Prepare a journal entry that recognizes income tax expense and income taxes payable for each of the years before 1980 .

b Prepare a journal entry that recognizes income tax expense and income taxes payable for 1980 .

c Prepare a journal entry that recognizes income tax expense and income taxes payable for each year after 1980 .

d What will happen in subsequent years to the Deferred Income Tax Credits account created in 1980 ?

e Now, assume that because of expanding physical volume of sales and general inflation. all pretax figures on the financial statements grow at the rate of 10 percent per year. What will happen to the balance in the Deferred Income Tax Credits account?

f Return to the steady-state, stable-price environment of parts a-d. Now assume that in a later year, say 1990, Rosenwald Stores declares bankruptcy. (This is not representative of Sears, Roebuck \& Co., but other retailers have gone bankrupt.) In 1990, collections of all sales made in 1989 are completed, but sales for 1990 fall to \(\$ 40,000\) all of which are collected in 1990. Cost of Goods Sold is \(\$ 24,000\) and All Other Expenses Except Taxes fall to \(\$ 30,000\). Prepare a schedule computing income taxes payable and an income statement for 1990 .

g What conclusions can you draw from this exercise about deferred income tax accounting? If you can find them, obtain financial statements for a recent year for Sears, Roebuck \& Co. What is the current balance in the Deferred Tax account for installment sales? What

fraction of shareholders' equity does this represent? By what percentage would Sears' income increase if deferred tax expense from installment sales were not deducted in computing net income? Discuss.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney