The only accounting entries made in respect of 73,000 received on 1 January 2011 as proceeds on

Question:

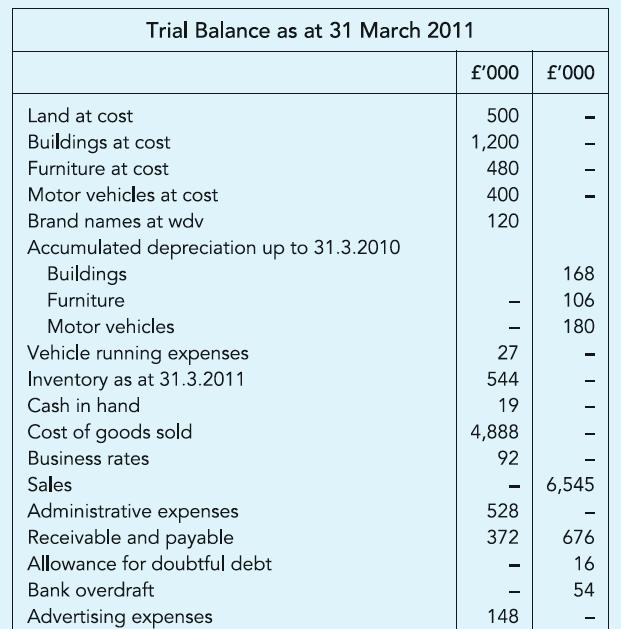

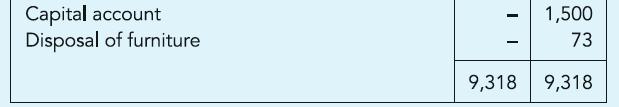

The only accounting entries made in respect of £73,000 received on 1 January 2011 as proceeds on disposal of boardroom furniture were posting of that amount to the Disposal account. The furniture disposed of had been acquired for £160,000 on 1 July 2008. The year-end Trial Balance of the business has been extracted from the books as shown below.

You are informed as follows:

(a) Goods invoiced to customers for £64,000 have been wrongly accounted for as sale though the customers retain the option to return these goods until a week after the year-end. These goods have been invoiced at cost plus a third.

(b) Brand names acquired on 1 April 2008 are being amortised on the sum of the years’ digits method, assuming a useful life of five years.

(c) A new vehicle was acquired for £60,000 on 1 December 2010; while furniture acquired for £40,000 when the business commenced on 1 April 2000 continues to remain in use.

(d) Buildings and furniture are both depreciated on the straight-line method at 2% and 10% per annum respectively; while vehicles are depreciated at 25% per annum on the reducing balance method.

(e) Advertising expenses include £38,000 paid to an advertising agency for a campaign which would commence only from 1 April 2011, while administrative expenses amounting to £42,000 remain unpaid at the year-end.

Required:

Prepare the financial statements of this business for the year ended 31 March 2011.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict