The Pennsylvania Steel Company files its income tax returns on a calendar-year basis and issues financial statements

Question:

The Pennsylvania Steel Company files its income tax returns on a calendar-year basis and issues financial statements quarterly as of March 31, June 30, and so on.

Assume that the applicable income tax rates and rules for 1979 are as follows:

(1) Effective tax rates are 20 percent of the first \(\$ 25,000\) of taxable income, 22 percent of the next \(\$ 25,000\), and 48 percent of all taxable income in excess of \(\$ 50,000\).

(2) Corporations must pay estimated taxes during the year. For a corporation on a calendaryear basis, 25 percent of the estimated tax payment for the year 1979 must be paid by April 15, 1979; 50 percent of the estimated tax payment for the year must have been paid by June 15, 1979; 75 percent of the estimated tax payment for the year must have been paid by September 15, 1979; and, all of the estimated tax payment for the year must have been paid by December 15, 1979.

(3) Any tax due when the tax return is filed in 1980 must be paid, one-half by March 15, 1980 , and one-half by June 15,1980 .

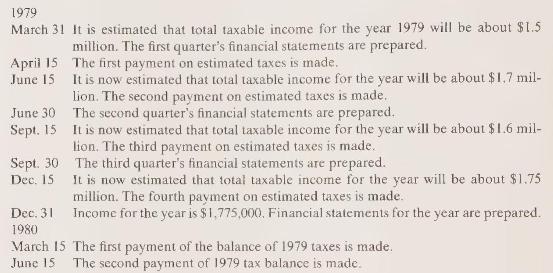

The following data are applicable to the company's 1979 income tax.

a Prepare schedules showing (i) For tax returns: estimated taxes for year, cumulative payments due and payment made for April 15, June 15, September 15, and December 15, 1979, as well as for March 15 and June 15, 1980.

(ii) For financial statements: tax expenses for the quarterly reports and annual report.

b Record the transactions related to 1979 income taxes in journal entry form.

c Present the T-accounts for Cash, Prepaid Income Taxes (if necessary), Income Tax Payable, and Income Tax Expense.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney