The Trial Balance as at 31 December 2011 reports a debit balance of 3,000 identified as taxation

Question:

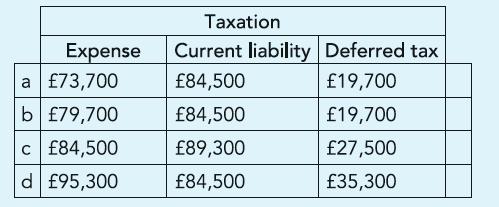

The Trial Balance as at 31 December 2011 reports a debit balance of £3,000 identified as taxation and a credit balance of £27,500 as deferred taxation. The debit balance in the taxation account is the amount by which tax paid in respect of 2010 exceeded the amount provided when that year’s financial statements were prepared. Tax on profits in 2011 is estimated at £84,500, while the taxable temporary difference as at 31 December is £98,500. The company pays tax at 20%. Identify the tax expense to be stated in the Statement of income for the year 2011 and the tax liability to be reported in the Statement of financial position as at 31 December 2011.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: