Trade debts receivable as at 1 April 2010 were 382,400. During the year ended 31 March 2011,

Question:

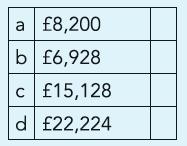

Trade debts receivable as at 1 April 2010 were £382,400. During the year ended 31 March 2011, sales and sales returns amounted to £859,600 and £18,400 respectively; while £659,800 was received from credit customers and £8,200 was written off as bad. An allowance for doubtful debts is maintained at 4% of debts outstanding. Calculate the expenditure written off in the year to 31 March 2011.

Transcribed Image Text:

a £8,200 b £6,928 c £15,128 d £22,224

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

A regular hexagonal prism with edge lengths of 2 inches is created by cutting out a metal cylinder whose radius is 2 inches and height is 4 inches. What is the volume of the waste generated by...

-

A bronze bushing is mounted inside a steel sleeve. Knowing that the specific weight of bronze is 0.318 lb/in3 and of steel is 0.284 lb/in3, determine the location of the center of gravity of the...

-

Compare the errors in the Midpoint and Trapezoid Rules with n = 4, 8, 16, and 32 subintervals when they are applied to the following integrals (with their exact values given). TT 9. In (5 + 3cosx) dr...

-

For the Somerset furniture Company described in Case Problem 10.1 in Chapter 10, determine the product lead time by developing a time line from the initiation of a purchase order to product delivery....

-

Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the...

-

What are some components to consider in the proper packaging of a plan? LO-1

-

Whales entangled in fishing gear. Refer to the Marine Mammal Science (April 2010) study of whales entangled in fishing gear, Exercise 10.32 (p. 552). Data collected for a sample of 207 entanglements...

-

Use transaction analysis to determine the effects of each of the following transactions in the general fund. 1. Salaries paid totaled $30,000. Additional salaries incurred, but not paid, totaled...

-

Based on our discussions, why was the Allowance for Bad Debt created? To record the amount of accounts receivable written off during the period. To record the net amount of accounts receivable that...

-

Trade debts receivable as at 1 January 2011 were 474,500. During the year ended 31 December 2011, sales and sales returns amounted to 728,400 and 11,500 respectively; while 752,200 was received from...

-

Trade debt as at 30 June 2011 amounted to 418,400. Allowance for doubtful debts brought forward as at 1 July 2010 was 18,800. The proprietor wishes a debt of 3,400 to be written off and the Allowance...

-

Internal Rate of Return Concerning IRR: a. Describe how the IRR is calculated, and describe the information this measure provides about a sequence of cash flows. What is the IRR criterion decision...

-

On July 1, 2021, P Company borrowed P160,000 to purchase 80 percent of the outstanding common stock of S Company. This loan, carrying a 10 percent annual rate, is payable in 8 annual installments...

-

Case Analysis Strategic leaders, being at the highest level of an organization, are responsible for charting its path to success. They visualize an ideal picture of their enterprise in a futuristic...

-

3 Refrigerant-134a enters a adiabatic compressor at 100 kPa and -24C with a flow rate of 1.300 m/min and leaves at 800 kPa and 60C. Determine the mass flow rate of R-134a and the power input to the...

-

The following trial balance of Bramble Traveler Corporation does not balance. Bramble Traveler Corporation Trial Balance April 30, 2025 Debit Credit Cash $6,221 Accounts Receivable 5,350 Supplies...

-

From this analysis, we can see than the actual number of unit produced was actually less than the forecasted, yet the actual revenue gain from were greater than the forecasted one. This situation...

-

How much more output will the average American have next year if the $18 trillion U.S. economy grows by (a) 2 percent? (b) 5 percent? (c) 1.0 percent? Assume a population of 320 million.

-

Refer to Example 9.15. Add the following functionality to this program: Allow the user to enter the cost of a gallon of gas on each trip and use a function, Cost() to calculate the cost of purchasing...

-

EBB Group (EBB), headquartered in Switzerland, is one of the worlds largest engineering companies. EBB applies U.S. GAAP, and reports its results in millions of U.S. dollars. Based on EBBs financial...

-

A South African paper company, SAPC Limited (SAPC), reports noncurrent Interest-Bearing Borrowings of $1,634 million at September 30, Year 6. SAPC applies IFRS and reports its results in millions of...

-

A Japanese car manufacturer (JCM) reported Sales of Products of 22,670 billion for the year ended March 31, Year 7. The Cost of Products Sold was 18,356 billion. Assume that JCM made all sales on...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App