Walter, R. Ron, and K. Kelvin are partners engaged in a retail business under the name of

Question:

Walter, R. Ron, and K. Kelvin are partners engaged in a retail business under the name of Prosperity Company. Their partnership agreement provides that net income or loss is to be shared in the following manner:

(1) Interest at the rate of 8 percent per annum is to be allowed on the partners' average capital balances during the year.

(2) The following salary allowances are to be provided: Ron \(\$ 17,000\) and Kelvin \(\$ 14,400\). Walter is no longer active in the business and receives no salary allowance.

(3) Any remaining income or loss is to be divided 40 percent to Walter, 35 percent to Ron, and 25 percent to Kelvin.

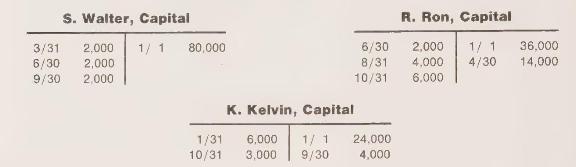

The partners' capital accounts during the year show the following data:

The net income from operations for the year, before deducting any salary or interest allowances, was \(\$ 54,960\).

a Show the calculation of the partners' average capital balances.

b Prepare a schedule showing the distribution of net income to the partners.

c Prepare a schedule of partners' capital accounts for the year.

Step by Step Answer:

Financial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030452963

2nd Edition

Authors: Sidney Davidson, Roman L. Weil, Clyde P. Stickney