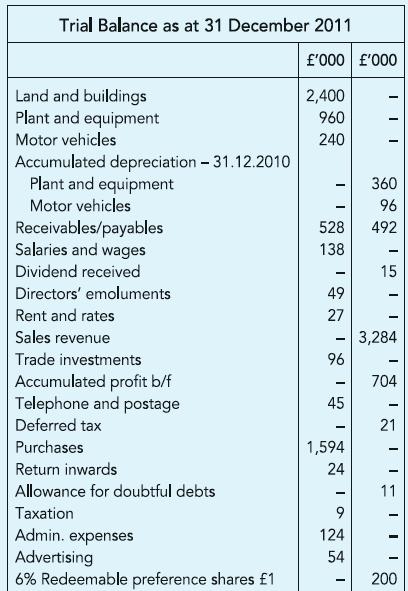

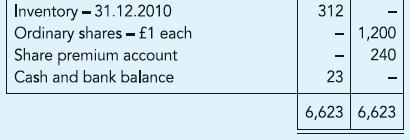

Year-end Trial Balance has been extracted from the books of Phoenix plc as stated. You are informed

Question:

Year-end Trial Balance has been extracted from the books of Phoenix plc as stated.

You are informed as follows:

(a) Cost of unsold goods, identified as £386,000, includes goods costing £40,000 used for display. These can be sold for only £27,000 provided £3,000 is incurred on restoring their condition.

(b) Land and buildings, though acquired in January 2001, were not depreciated. Directors wish to depreciate buildings assuming that 75% of the cost relates to buildings which are expected to remain in use for 50 years.

(c) £8,000 of receivables is to be written off and the allowance adjusted to cover 5% of receivables.

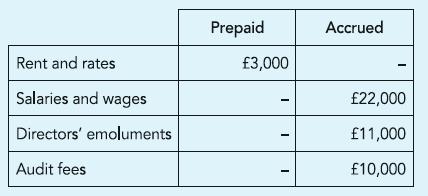

(d) Expenses in the year need to be adjusted as follows:

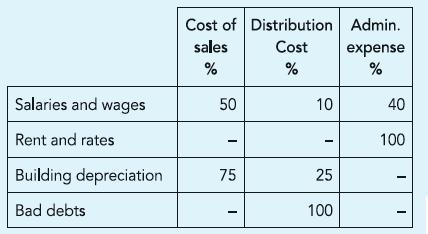

(e) Expenses are to be functionally allocated as follows:

(f) Plant and equipment are to be depreciated at 10% using the reducing balance method, while motor vehicles, including one acquired for £60,000 on 1 July 2011, are depreciated at 20% using the straight-line method.

(g) The amount stated as taxation is the under-provision for the previous year. Current tax, at 20%, is estimated at £179,000; while the taxable temporary difference at the year-end is £120,000.

(h) A bonus issue of one for every four shares was made on 4 January 2011, the cost being written off from the Share premium, followed by a cash issue of 200,000 ordinary shares at 120p each.

(i) A dividend of 5p per share, declared by directors on 31 December, is yet to be accounted for.

Required: Prepare for publication:

(a) A Statement of comprehensive income for the year ended 31 December 2011.

(b) A Statement of changes in equity, for the same period, tracing all movements in equity, and

(c) A Statement of financial position as at 31 December 2011.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict