(a) On I January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for 16,200...

Question:

(a) On I January 20X7 Parent Ltd acquired all the ordinary shares in Daughter Ltd for £16,200 cash. The fair value of the net assets in Daughter Ltd was £ 12,000.

(b) The purchase consideration was satisfied by the issue of 5,400 new ordinary shares in Parent Ltd. The fair value of a £1 ordinary share in Parent Ltd was £3. The fair value of the net assets in Daughter Ltd was £ 12,000.

Required in each case:

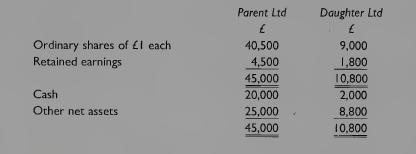

Prepare the statements of financial position of Parent Ltd and the consolidated statement of finan¬ cial position as at I January 20X7 after each transaction, using for each question the statements of financial position of Parent Ltd and Daughter Ltd as at I January 20X7 which were as follows:

Step by Step Answer:

Financial Accounting And Reporting

ISBN: 9780273778172

16th Edition

Authors: Mr Barry Elliott, Jamie Elliott